Minnesota's major nonprofit health plans held close to $7 billion in assets at the end of last year. While Minnesotans aren't individually listed as account holders on the official financial paperwork, they should be.

Taxpayers through the years played a major role in nurturing the asset growth. Nonprofit plans have long enjoyed substantial state and federal tax breaks. The plans also were entrusted to run publicly-funded medical assistance programs, a dependable and often lucrative line of business. And for 40 years, state law shielded these plans from competition from for-profit insurers.

A 2017 decision by Minnesota legislators to end key restrictions on for-profit insurers has triggered important questions about the future of $6.7 billion held by companies such as Blue Cross Blue Shield Minnesota, HealthPartners, Medica and UCare. Namely, what happens to the public's considerable stake in these charitable assets if these companies convert to for-profit status or are acquired by for-profit firms?

The answer ought to be quite clear: These assets aren't simply there for the taking. Strong safeguards are needed to ensure that they aren't, which is why the Legislature ought to pass the reasonable protections proposed by Rep. Jennifer Schultz, DFL-Duluth, and championed by state Attorney General Keith Ellison.

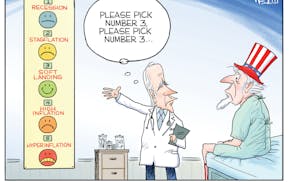

The time for action is dwindling fast. A two-year moratorium on so-called "conversions" to for-profit status — one enacted to temporarily protect these assets — ends this July. And while there are no indications a conversion is imminent, it's better to be proactive than to scramble if an insurer decides to go in this direction or is acquired by a for-profit company.

Former Attorney General Lori Swanson merits praise for pushing for reforms like this before she left office. In a commentary on these pages, Swanson highlighted scandals that happened in other states when lawmakers failed to act. She rightly dubbed them "corporate raids on the treasuries of nonprofit health insurance plans" and noted that this often was followed by fat bonuses for executives.

Ellison's office has energetically taken up this policy baton and has pointed to California as an example to follow. There, nonprofit assets protected when large insurers converted to for-profit status in the 1990s led to the creation of a foundation whose mission is to improve public health statewide.

Around 19 states have put permanent protections in place to guard against abuses. So Minnesota would be far from an outlier in passing reforms. The bill led by Schultz is modeled on other states' efforts.

Schultz's bill has been folded into the large House health policy bill, HF2414. Its prospects look good in the DFL-controlled chamber, but there's little momentum behind its companion bill in the Republican-controlled Senate.

That's regrettable. There isn't a good argument against enacting these reforms. Putting them in place is just doing the work that the 2017 Legislature neglected.

In legislative testimony, a lobbyist for the state's nonprofit insurers raised concerns that such measures would somehow limit flexibility and put plans at a competitive disadvantage against for-profit insurers. But the protections kick in only if a switch to for-profit is made or if the plan transfers significant assets out of Minnesota, such as to help an out-of-state subsidiary.

In addition, the state's nonprofit plans would continue to have substantial advantages over for-profit insurers. Their nonprofit tax breaks would continue. And their long history in the state would give them a powerful leg up in building wide medical provider networks, something consumers look for when buying a policy.

The proposed conversion protections are good policy. Republican health committee chairs Sens. Michelle Benson, R-Ham Lake, and Jim Abeler, R-Anoka, should be urging their party to support reforms. Their voices are needed but missing.

"Nonprofits don't have owners or shareholders; their charitable assets belong to the people," Ellison said. "Shipping these assets out of our state, using them to pay for-profit executives' exorbitant salaries and bonuses, or for any other for-profit purpose is wrong."