Berry Global Group's (BERY) Unit to Issue Senior Secured Notes

Berry Global Group, Inc. BERY yesterday announced an offering of €725 million worth of first-priority senior secured notes. Notably, these offerings will be carried out by Berry Global, Inc. — a wholly-owned subsidiary of Berry Global Group.

Per the company, the first-priority senior secured notes will be issued in two parts — including notes due to mature in 2025 and the other set to expire in 2027. The proceeds from the notes offering will likely be used by the company to repay Berry Global’s existing term loans and some related expenses.

Notably, Berry Global Escrow Corporation — an indirect, wholly-owned subsidiary of Berry Global Group — issued $1,250 million worth of first-priority senior secured notes and $500 million worth of second-priority senior secured notes in May 2019. Notably, the first-priority senior secured notes are due to mature in 2026, while the second-priority notes will mature in 2027.

Berry Global Group’s High Debt Profile

The company has a highly leveraged balance sheet. At the end of fourth-quarter fiscal 2019 (ended Sep 28, 2019), its current and long-term debts were at $11,365 million, reflecting a 94.5% increase from the previous year. Net interest expenses were $329 million in fiscal 2019, up 27% year over year.

Although the current notes offering will help in repaying existing term loans, we believe that it will also add to the company’s existing debt balance. Unwarranted rise in debt levels, in turn, can inflate its financial obligations and hurt profitability. Notably, the company continues to predict interest expenses of $500 million for fiscal 2020 (ending September 2020).

Zacks Rank & Stocks to Consider

With a market capitalization of $6.3 billion, Berry Global Group presently carries a Zacks Rank #3 (Hold). The company benefits from acquired assets, robust capital-allocation policies and restructuring initiatives. However, high debts, forex woes and inflating costs remain concerning.

Over the past three months, Berry Global Group’s shares have gained 19.9% compared with 4.8% growth recorded by the industry.

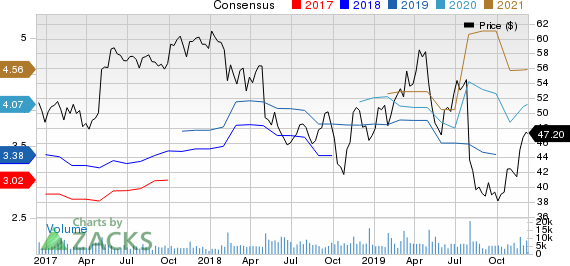

Furthermore, the company’s earnings estimates have been increased in the past 30 days. Currently, the Zacks Consensus Estimate for its earnings per share is pegged at $4.07 for fiscal 2020 and $4.56 for fiscal 2021 (ending September 2021), reflecting growth of 6.5% and 0.4% from respective 30-day-ago figures.

Berry Global Group, Inc. Price and Consensus

Berry Global Group, Inc. price-consensus-chart | Berry Global Group, Inc. Quote

Some better-ranked stocks in the Zacks Industrial Products sector are Tennant Company TNC, DXP Enterprises, Inc DXPE and Standex International Corporation SXI. While Tennant currently sports a Zacks Rank #1 (Strong Buy), DXP Enterprises and Standex carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for Tennant and DXP Enterprises have improved for the current year, while the same has been unchanged for Standex. Further, positive earnings surprise for the last reported quarter was 40% for Tennant, 16.39% for DXP Enterprises and 2.11% for Standex.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

Standex International Corporation (SXI) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research