Trump's tariffs hit Texas manufacturers, spark fears for the future: Survey

Profit margins for Texas-based manufacturers are taking a dive as a result of President Trump’s trade wars, according to a survey released on Monday by the Federal Reserve Bank of Dallas.

According to the Dallas Fed’s survey of Texas’ manufacturing activity in June, 29% of companies surveyed reported a decrease in profit margins as a result of tariffs. That stands in stark contrast to September of last year, when only 3.9% reported increases.

The central bank’s study comes against a backdrop of an ongoing trade dispute between the U.S. and China that shows no signs of de-escalating — and is visible across a range of industries and key gauges of the economy.

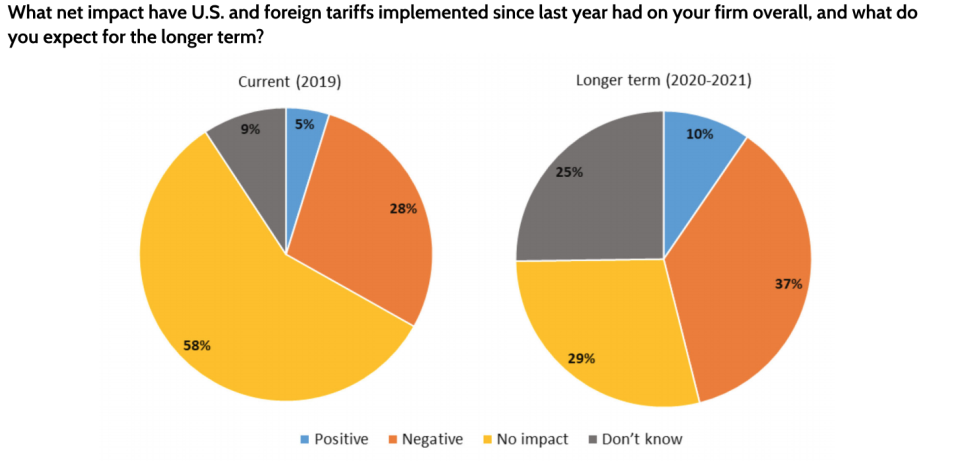

According to the Dallas Fed, 58% of Texas companies surveyed currently reported that U.S. and foreign tariffs had no impact on their firm overall, while 28% reported a negative impact.

Yet those numbers changed dramatically when Texas businesses were asked to project impact in 2020-2021. A whopping 37% reported the impact would be negative, while only 29% reported no impact.

Manufacturers in Texas are not immune to the nationwide fears resulting from increases in tariffs. Some 41% of manufacturing executives nationwide say that their businesses have already been negatively affected by the tariffs.

“It has led to austerity measures even in a year of projected overall revenue growth, but with lower margins, and to headcount/hiring freezes even with record production in some areas of the company,” one respondent told the Dallas Fed in its survey.

Alarm bells are sounding on the current impact of tariffs, but many companies surveyed mentioned how future uncertainty has affected current production.

“It makes planning difficult, specifically in regard to capital investment,” reported a nonmetallic mineral product manufacturer, who raised questions about what would happen if tensions were raised further.

Global Risks, Local Fears

Consumer tech companies like Best Buy (BBY) and Roku, (ROKU), along with toy companies such as Hasbro (HAS) have in recent days joined the chorus of voices lobbying the Trump administration to reconsider tariffs.

Texas’ vast economy is a hub for energy and manufacturing, and sits in the middle of the pack of states most susceptible to tariffs from China, according to analysis from JP Morgan Chase.

Texas’ state GDP could be affected by 2.5% by the newest round of tariffs —lower than Tennessee’s expected impact of 7.3% but far higher than Montana and North Dakota’s economies, the bank found.

Many of the concerns for Texas businesses, though, are centered around how new tariffs might affect the broader economy—and their bottom line.

Calder McHugh is an Associate Editor at Yahoo Finance. Follow him on Twitter: @Calder_McHugh.

Trump, Sanders embrace competing versions of economic populism

There's a gap between jobs and job-seekers, and a housing crisis is making it worse

The jobs report is even worse than it looks in these six sectors

These US industries could take the heaviest hit from new tariffs

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.