“Give Me a Growing Environment, It’s Easier to Run the Railroad”: CSX CEO.

By Wolf Richter for WOLF STREET.

CSX reported fourth-quarter and annual results Thursday evening: revenues for the quarter fell 8% to 2.88 billion, in line with the freight recession where overall shipments by all modes of transportation in December fell 7.9%, the steepest year-over-year decline since November 2009.

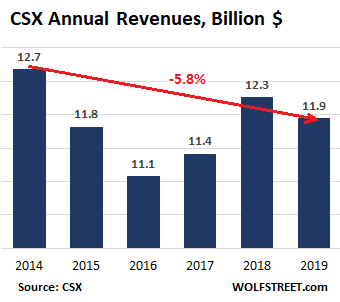

Annual revenue fell 3% to $11.9 billion, and were down 5.8% from 2014. This is not the chart of a growth company. But over the same period of the 5.8% revenue decline, the price of its shares has soared 121%.

“Give me a growing environment, it’s easier to run the railroad,” CEO Jim Foote noted during the earnings call. “Right now, we’re in tough conditions to put up the numbers that we’re putting up.”

And CSX is not expecting a snapback. “We expect underlying economic demand to remain relatively consistent with current levels,” Foote said (transcript via Seeking Alpha). “It took industrial activity awhile to cool off, and it will take a while to heat back up. Based on this, we expect full-year revenue to be flat to down 2% versus 2019.”

Executive VP Mark Wallace added:

Going into 2020, we expect a continuation of the current macroeconomic trends. We know the consumer economy remains strong. But PMI and industrial production and other macro indicators suggest that we’re not going to see a near-term increase in industrial activity.

Industrial production is projected to be relatively flat for the year and the PMI read in December was 47.2, which was the second worst since ‘09 and the 5th consecutive month signaling contraction. So given this we’re not forecasting a hockey-stick recovery, but any improvement in the macro environment would be upside for us.

Revenue increases and declines by category in Q4 year-over-year, from the strongest to the weakest:

- Minerals (+6%);

- Agriculture and food products (+2%)

- Forest products (-1%);

- Fertilizers (-2%)

- Chemicals (-4%);

- Metals and equipment (-6%);

- Intermodal (containers, trailers piggybacking on rail cars, -9%);

- Automotive (-10%);

- Coal (-22%).

Despite declines in volume, CSX is raising freight rates.

The company said that the 8% decline in revenues “more than offset the benefit of pricing gains” in every category except coal. In other words, despite declines in volume, the company has managed to raise freight rates.

When asked about price cuts to stem the 9% decline in its intermodal business, executive VP of Operations, Jamie Boychuk, flared up:

No, listen, Allison, we’re not going to be cutting prices to grow the business. I think the team here at CSX has worked away too hard to do everything we’ve done to provide our customers with exceptional service out there. Large portion of the vast majority of our intermodal network on the domestic side is under long-term contracts anyway. We’re not looking to grow by just going out and slashing rates. That’s not our game plan. That’s not what we’re going to do.

Cutting expenses.

Operating expenses fell 9%, based on the company’s focus to operate more efficiently – and we’ll get to those elements in a moment.

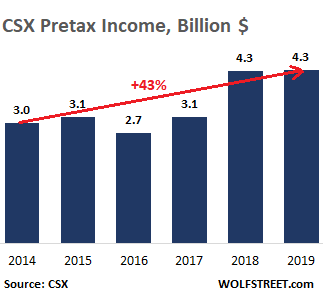

And income before taxes fell 11% to $981 million in Q4. For the full year, income before taxes ticked up less than 1% to $4.3 billion. So, revenues fell 5.8% from 2014 through 2019; and over the same period, income before taxes rose 43%, while its shares, as mentioned above, soared 121%:

“Labor efficiency” and other “efficiencies”

The difference between those declining revenues and rising pre-tax income since 2014 is the decline in expenses – and this has become a particular passion at CSX, including what it calls “labor and asset efficiency.” So you know what’s coming.

In terms of “labor efficiency”: During 2019, the company reduced its total headcount by 1,567 people, or by 7%, to 20,908 employees. In Q4, the “active locomotive count” was down 10% year-over-year, and other rolling stock had been trimmed down too, which allowed the company to cut its “mechanical workforce” by 9%, and to slash its “mechanical overtime expense” by over 40%.”

These headcount reductions are mostly accomplished by “attrition,” rather than publicly announced waves of layoffs. CFO Kevin Boone:

We’ll continue to focus on managing attrition. There’s a process here where we look at every job that comes available and ask ourselves, given the model, whether that job is necessary. So we’ll continue to evaluate those. With the lower volume, there’s opportunities on the operating side that we’ll find. So we’ll continue to manage the labor side. It’s not all about headcount. It’s about the overtime which we saw some great success in the fourth quarter.

We have big targets next year to continue to drive the overtime down as well. So it’s across the board on the labor savings.

Fuel expenses in Q4 fell 15% year-over-year to $216 million. Part of it was due to a 7% drop in the per-gallon price of fuel. The other factors were the decline in volume and “significant efficiency improvements.”

CEO Foote then mused on the difficulty of cutting expenses in line with the economic environment and revenue declines:

If the business had dropped off 10%, 12% in a couple of weeks in a traditional kind of recession scenario, it would have been easier for us to go in there and find the equivalent amount of costs and take it out of the company.

When it was a slow drip week after week, month after month, a percent here, a percent in the half-year and continue to go down, down, down, down, down, it was more difficult for us to respond to that because we were fearful that we would cut service in areas where we were in an attempt to reduce cost, and we would perpetuate the downward trend by driving more business off the railroad and on to the highway.

So that is a challenge: where can we cut, and where can we maintain our levels of service? If the volumes continue to decline, it creates opportunities for us. And at some point in time, you just get a little more aggressive. We have not done that and – but we have the ability, if it was necessary.

“This isn’t a slash-and-burn exercise that we’ve been going through; it’s controlling the costs,” added Operations VP Boychuk.

Even while revenues fell 3% for the year, and 8% in the quarter, and while headcount was being cut by 7% in the year, and other things were trimmed and whittled down, CSX blew $3.4 billion in 2019 on buying back its own shares – which exceeded its after-tax income of $3.33 billion.

Shipment volume in the US by truck, rail, air, and barge plunged 7.9% in December compared to a year earlier, the 13th month in a row of declines, and the steepest since November 2009. Why is this happening? Read... US Freight Shipments Plunge at Fastest Rate since 2009, Hit 2011 Level: This is Getting Surprisingly Ugly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

“But over the same period of the 5.8% revenue decline, the price of its shares has soared 121%.”

Hey, it’s a rally. The company is doing buybacks and the Fed is supporting the market. Who cares about that other stuff?

In the words of chuck prince, if the music is still playing, got to keep dancing

Yeah, but dance next to the door.

The company’s net income is also growing due to implementation of PSR. Lots of efficiencies to be gained

You are correct, it’s a rally and it will not relent. It’s long past time to stop caring about the “other stuff”. Several things are now clear:

1) When the Fed creates an abundance of new currency it flows into the financial sector and pushes up stock valuations.

2) The Fed has now admitted their currency creation policy is pushing up stock prices.

3) The Fed has shown zero concern about their policy pushing up stock valuations.

4) There is no indication the Fed will ever stop creating a tsunami of new currency and continue to push the market up.

5) The US government is dependent on the Fed creating new currency to fund their deficits. The Fed has created a situation where their counterfeit money is necessary to fund government spending. The counterfeiting can never stop – simple arithmetic.

6) Almost nobody cares because a) wealthy people borrow the cheap currency and use it to buy assets b) poor people are in debt and inflation provides a get out of financial jail free pass and c) people who worked, saved and will be wiped out by inflation are a tiny minority with no voice or agency and therefore have zero political relevance – saving is for suckers.

It’s happening. The Fed is debasing the currency to 1) fund the government and 2) inflate assets. Deal with it because complaining won’t help (believe me I’ve tried).

The Fed continues policy that harms savers because savers don’t matter. The Feds neo capitalism theories and models no longer require savers – they are the appendix of the economy. Bernanke refers to savers as hoarders, how best to solve the world’s hoarder problem? Annihilation!

I think you might be taking it too far. As long as you are able to earn enough investment income to offset inflation, who really cares what the Fed does? A conservative mix of 20% Blue Chip stocks, 70% ST bonds, and 10% gold will beat inflation at around 2-3%. If it doesn’t, that means rates have gone up or stock prices have come down, and you now have plenty of dry powder to scale in at lower prices.

If you try for a better return (say 4-10%), you go out on a limb. Stocks are all-time high valuations by most metrics. Rely on the Fed and you will get burned by master flip-floppers. In reality, what the Fed wants and what the Fed gets are always two different things.

The Fed is playing with fire and it is now publicly admitting it. They say they don’t have the tools with rates this low (everybody except Dilirious Bernanke), and they are correct. They are preparing the public for a reckoning and trying to save face at the same time.

There’s no sense in organizing your portfolio around future hyperinflation that hasn’t shown any sign of occurring yet.

The appendix DOES have a use, and an important one.

Keeping people away from the OTC gut “remedies” wasteland is likely the biggest!

How about savers are the plantar wart of the economy???

Disclosure: total saver (hoarder) since FC…..CDs and Treasuries…..F FOMO!

I’ll just downsize more.

Oh yeah, just bought my yearly I-Bond, almost have a big enough stash of them I can hopefully let them all ride till I’m dead and they go to loved ones. (Lotta things stink worse than CPI-U…so far.)

No beef with your good post AT ALL, just had to add my Bio-2 cents, since I’m here trying to learn financial stuff/lingo.

Update:

CFO Foote indicated that the company is headed in the right direction and that they expect revenues to fall ‘at least 20% but our target is 30% in 2020’

Foote went further stating, ‘We’ve already had discussions with the Fed and they have indicated that if we can achieve these targets they will make available a facility of $30-50 billion a 0 interest that we will tap to continuously buy back shares throughout the year and make 2020 a stellar year for the company’

Analysts including those from JPM, Goldman Sachs, and Willy Winky’s House of Great Investments have a Buy CSX.

Wolf, eat the small loss on your short and dump everything into CSX.

These guys ‘get it’ and they are going places!

dear W.W:

can i please invest in your House of Great Investments Fund? i will gladly pay more than the next guy to get in on that action!

I might even consider a tiny investment if convinced WW has paid off the right people.

so what I read from this is global SLOW DOWN to continue

but hey financial engineering that layoff of EMPLOYEES

will result in fewer FULL TIME JOBS available – but hey we’re still missing some 1,200,000 FULL TIME(I didn’t say living wage) jobs since 2009

well except the DEBT BUBBLE of massive proportions

In the northeast (NY, CT, MA corridor along I95), they took freight off clogged highways and onto freight trains… but several 100+ year old train bridges turned out to be in worse shape than the neglected highways.

In other parts of the country, freight (truck and train) is doing just fine, thank you.

One truck company that got massively over levered on “free” bernanke bucks collapsed two weeks before Xmas… under too much debt.

And Jeff bezos went and borrowed billions to build out his own truck fleet, which seems short sighted if delivery traffic was imploding.

I don’t see any signs of recession in freight shipping. I see a significant adjustment from bankrupt states to better run states, and some freight modes are playing defense — adapting late to a trend even the census bureau picked up on long ago. Heck, even CNBC noticed people are moving out of failed states.

This isn’t a freight story. This is just a symptom of taxpayers giving up on poorly run states (CA, IL, NY,, NJ, CT, etc).

You are collapsing a whole slew of factors into your own politically biased conclusion that certain states are poorly run/failing. Your political bias makes your comments close to unreadable.

The states you mentioned have the 1st, 5th, 3rd, 8th, and 23rd ranked GDPs, respectively, among U.S. states. Caifornia, New York, and New Jersey have positive population growth; Connecticut is basically flat, and Illinois has only recently gone negative. And most of those states are in the snow belt which affects population growth.

It is easy to move the goalposts on this argument though since you can just cherry pick whatever stats you want to support your conclusion that these states are ‘failing’. Which is why I won’t participate in a back-and-forth on this and will try to avoid your comments in future.

Absolutely right! Why digress? California’s G.N.P. is amongst the top 10 in the world, based on food and service. Texas is up there because of oil, a non-renewable and tech. service,but far behind many States. Bill Gates’s, Bezos’s and others know California draws talent and expertise.

You need to do some fact checking. CA, IL, NY, CT are all LOSING population. According to census, according to moving companies, according to tax receipts, and according to those state governments.

If you can’t even get that right, who cares about your politics.

I know Wolf doesn’t want to babysit dumb comments, but holy sheet you are misinformed.

Most estimates are that CA continues to gain population, but at a much lower rate.

The only significant increase in population is from foreign immigration. Many experts refuse to even try to count the numbers of illegal vs. legal immigrants.(!)

There about 200,000 fewer deaths than births in CA, which is a gap that is closing. Fertility rate is falling. Most of the US is in a sub-replacement fertility situation, and CA is in the bottom 10. Fertility rates tell a lot about the quality of life in a society.

Domestic outmigration is enormous. It’s up to about 200,000 net per year.

Whether any of this is “good” or not is open to discussion.

Example: the Fed slashed interest rates for decades, making it impossible for Illinois to fund it’s previously fully funded and right and good retirement program. Now Illinois have to raise taxes to pay for the Fed stealing their retirement interest that they paid for. Enter you, blaming problem caused by Fed, on high taxes. 100% Wrong. This is a NATIONAL problem, not s state problem.

Yak now,

If YOU lived in Illinois or California, and the Federal Reserve stole YOUR retirement savings for no other reason than because you have your retirement savings in Illinois or California… and if you stayed in state you have to pay AGAIN the money the Federal Reserve stole from you, but if you move out of state you would NOT have to pya…wouldn’t YOU move out, too?

I would.

And so would a lot of others.

So what’s your point?

Yak now,

My understanding is that IL is losing population. I haven’t checked NY and CT. But I live in CA and I watch this down to the millimeter here because it’s a huge issue here. And CA is NOT losing population yet.

There is a lot of domestic out-migration, as you know, but the domestic in-and-out-migration numbers that you see everywhere — such as the U-Haul index, etc. — don’t show the international in-migration.

CA is a gateway state, so there is still a large influx (a big part from Asia). So in net numbers, domestic and international, CA is still growing. But the growth is slowing down, and the fear is that the international in-migration, particularly from Asia, will slow down, and that CA might go the way of IL and lose population. This is a real possibility, but it hasn’t gotten there yet, though we’re getting closer.

I looked it up and you’re wrong. It is a fascinating story and there is a lot of information out there. California grew last year by half a percent. Nearly 40,000,000 people. That said I can still afford a house in the town I was born in by Mare Island.

Anecdotally and based on personal research California is bleeding population to neighboring states, raising real estate prices in Nevada, Arizona, Oregon, and Washington, possibly Idaho and Utah as well with some movement to western Montana.

Maybe sometimes our ideology prevents us from seeing things as they are. Maybe, as Yogi Berra is alleged to have said, “Nobody goes there anymore, it’s too crowded.”

He summarized his complete political agenda in short at the very end of the article on Cass Freight Index, (10-15 comments or so from end) if you just want to see it sans camouflage. FWIW.

The only problem with your theory is those leaving are higher paid than those arriving by quite a margin from what I’ve seen and liberal wing nut blue states are suffering no doubt

You should fact check your statements before making them.

The top states with net domestic migration loss were California (-203,414), New York (-180,649), Illinois (-104,986), New Jersey (-48,946), Massachusetts (-30,274) and Louisiana (-26,045).

US census

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=2ahUKEwjOutWom47nAhVVVc0KHdZDBZQQFjABegQIDBAF&url=https%3A%2F%2Fwww.census.gov%2Fnewsroom%2Fpress-releases%2F2019%2Fpopest-nation.html&usg=AOvVaw18gvoOKAXu6y1hKQaXXn13

Jdog,

Thanks for the link to the Census table. It says: of the top 10 most populous states, only two lost population: New York and Illinois. California gained 50,635. Here is the table. I added the “Change” column:

“Poorly run” Blue States like CT pay more to DC in taxes than they receive. The Red States are on the dole, and the tab is being paid by the states you are bad-mouthing.

That’s the trouble with seeing everything in left-right, blue-red, liberal-conservative bumpersticker vision. The real world is much more complex.

Please build a wall around California. Those people are crowding up my nice indefatigable market cultist neighbourhood. Ask Oregon to pay for it.

But please keep the nice checks and Federal subsidies coming. Thank you.

– Red Stater.

Black and white thinking is much easier, takes a lot fewer synapses, hence it’s popularity. But good situational awareness is why we have big brains for our size, with lots of synaptic capability, and why our hominid ancestors survived against the unbelievably tremendous odds.

“The unexamined life is not worth living for man”

“There is no evil, only misunderstanding”

-Socrates (Plato)

Rail service to Humboldt County ended in 99? This is a commodity rich area, lumber and fishing. Could be those markets were played out, if not for a general change in the global economy with fewer bulk shipments. The BDI ceased to be a good indicator of global economics. Rail companies have pricing power because there is a natural barrier to entry, a moat around them. For Humboldt the loss of the railroad coincided with improvements to the 101 highway. Tourism still matters, but even pot growers are taking a hit. Friend retired, can’t sell her house there, moved to AZ. Part of it is politics.

Train freight down

Truck freight down

Electric use down

Car sales collapsing

Without 10 years of QE to infinity, TARP, HARP, bailout after bailout, not one banker in jail, zero interest rates, adding more to the deficit than all other administrations combined…

It would be a great time to short the market.

US consumption has cooled since August as well(nobody wants to admit this yet though) back to the mean trend line since 2010.

Follow debt markets: corporate debt consumer loan(auto, student) debt levels. When they contract the gig is up.

But capitalism has always been that way. 19th century economics is not a good point to look at it since most everybody lived in poverty by todays standards and consumer debt market basically did not exist yet. It was all investment debt bubbles around building what would become the modern world. Now you people who post on this board are the offspring of that building. Debt based investment was replaced by debt based consumption in the 20th century, you are its warriors.

Debt based investment creates prosperity…

Debt based consumption creates economic collapse….

Freight shipping patterns are shifting geographically, and some companies are still using last decades play book. Might be a long/short trade within the sector. Long /short trade is what amazon / bezos are doing.

Companies that used borrowed money to leverage up on the status quo are caught flat footed by unsustainable debt levels.

Car companies that levered up as if cash for clunkers was real are discovering that robbing the future to pay for the present doesn’t work.

Tesla isn’t a viable, even if one thinks a glorified golf cart is “cool”. GM and Mercedes both have superior technology, and they aren’t ready yet.

Electricity use is flat, not down. One would expect it to be way down based on LED bulbs and factories moving abroad — but instead usage is holding steady.

If by “shorting “the market” , you mean short the FAANG stocks and Tesla, then yes. When CNBC says “the market” went up last year, they are talking about a handful of stocks that actually went up. A lot of stocks have been going sideways for years.

Shorting bubble FAANG stocks to buy value stocks makes sense from a fundamental view, but not if one thinks the central planners still have credibility. They are what caused the bubbles in the first place.

I agree 100% that central banks have lost their mojo. It was all bread and circus to begin with.

But I think desperate and cornered animals will do crazy things, and that is what the central banks are.

But I think desperate and cornered animals will do crazy things, and that is what the central banks are.

I think the CBs are scared. That means everybody should be scared.

Except me and the Hutterites. I try to keep as many degrees of separation between myself and CBs as possible. Handling currency or digital money any more makes me uncomfortable.

Some might say it might be a good time to start bucket-listing in earnest.

Remember 2008? How the global economy seized up for a few days?

Then the CBs rode to the rescue.

Well they’ve been doing ‘whatever it takes’ for 11 years. i.e. They are doing absolutely anything and everything to prevent another 2008.

As this sh/t show begins to circle the drain, make no mistake, they will throw the kitchen sink at this, they will sacrifice virgins on a fire if they think it will help.

Every last bullet will be fired. They will throw the gun at this thing. They will scratch and claw and beat their fists on its head.

Whatever it takes – will eventually fail.

Ya you can be short and you will eventually make a fortune.

But I recommend spending it VERY quickly.

Because when the world seizes up this time around the CBs are gonna be out of ammo.

We will see what 2008 would have looked out had the CBs not intervened.

And that will be grim.

Anyone have any good bucket list ideas?

This time around, it is not the member banks of the Fed that are holding the bag, it is the pension funds. The CB has little to lose, but the people who have stakes in the pension funds will be taking a huge hit….

Take long swims.

Everybody knew from the very beginning back in 2009 or thereabouts that this reflation through monetizing everything would end in tears Looks like that truth is becoming more evident lately with all the statistics

gee why didn’t they take that 3.3 billion and pay their workers a dividend? haha oh what’s wrong with me.

Yes, a small price to pay for employees loyalty and to calm nerves, but that logic may not prevail .

Out of curiosity, I looked up the CSX most recent form 10Q. Overall, the number don’t seem bad, but too much debt for my taste. The share price has doubled in the last 3 years. So, I am starting to get the sense, as I think back to Wolf’s article on the most indebted companies in America, that many of the top management of these various large and indebted companies, now probably in the 8th or 9th inning of their career are going for broke (literally) by effecting huge leverage in order to get the share price up, and cash out. This, in turn leaves the younger generation with the problem of dealing with the debt. Just and observation.

Actually, shame on you unamused for not putting 2+2 together as you should be able to tell from my initial words that I am a man for and of the people. But, our gov’t was certainly not a steward when it came to protecting and guarding the sacrosanct monies that the people put into the social security system. Very, very sad.

You should not be falsely characterising the US SS system as a Ponzi scheme because it most certainly is not. You’re perpetuating disinformation intended to discredit it.

“The American Social Security system has been in continuous successful operation since 1935. Charles Ponzi’s scheme lasted barely 200 days.”

https://www.washingtonpost.com/blogs/ezra-klein/post/is-social-security-a-ponzi-scheme/2011/08/25/gIQA2t0dcL_blog.html

The money that was there theoretically was stolen by Lyndon Johnson to pay for Vietnam and his great society welfare.

Obviously untrue, since it’s still generating surpluses.

Social security is a welfare program. Taxing one group of people to pay benefits to another group of people is by definition a welfare program.

The fact that someone pays the welfare of some old people over his working life does not obligate a younger generation to now pay his welfare when he becomes old. The younger person was not alive to agree to these welfare payments and is under no obligation morally or legally if he and his fellows agree to overturn the welfare law. Majority rules, and you are soon becoming a minority. It might behoove boomers to quit complaining about those lazy millennials.

Off topic but I didn’t raise the topic and honestly are we still pretending earnings matter.

“CSX blew $3.4 billion in 2019 on buying back its own shares – which exceeded its after-tax income of $3.33 billion.”

You would think buying more energy efficient trains might have been a wiser investment of that 3 billion.

You would think buying more energy efficient trains might have been a wiser investment of that 3 billion.

Efficient trains don’t boost the incomes of corporate officers. Indirectly liquidating the company does.

The problem of aligning the interests of management with those of the firm is a problem that has never been solved, although it is a problem management can easily exploit in several ways for personal profit to the detriment of the firm.

I took classes at 3 colleges. One for 8 years, Sonoma State College.

Outside the door of their Management Department a big sign said,”

Management is the art of helping people work together to accomplish group goals”.

I never had any close management major friends, so I never knew if that was true.

1) CSX is up $3.04 > 4% this week. CSX failed to close the huge gap

from July 16/ 17 2019, a large supply bar, on high volume.

2) CSX weekly is not a H&S. CSX might be in the last point before big red supply bars will appear on the chart again.

3) CSX will fall from the current price @ 76.40 to well below 58.

4) On the other hand u will not see large supply bars, in the 2020 election year, in the US bond market. No bonds bear market. 5) The Fed isn’t out of ammunition.

6) US gov overdraft account in the F.R. banks will grow and US bonds

supply will shrink.

6) The yield curve will flatten. There will be no inflation.

Out of work railroad employees might find work building oil, natural gas liquids and natural gas pipelines, storage terminals and port expansions.

With new home construction surging to a 13 year high, there must be some construction companies paying overtime.

There are too many recent IPO’s not paying taxes. It is not economically efficient. It might be a bubble.

I have a funny feeling they will never tell us if were in a Main Street recession. Markets will be rocket high, but the people will be homeless or poor.

They lie about everything else, so why not? The truth would just make people unhappy.

Here is there, and high is low.

All may seem undone.

What is true, no two men know.

What is gone is gone.

If you are caught in a recession (81-85 for me) you don’t need to be told. But hey, on the bright side, I did learn that rats coming out of the toilet is NOT a popular myth.

Wolf ,

I know you don’t want to baby sit comments, but your blog won’t be taken seriously if people are claiming that populations in CA, IL, NY, and CT are anything but shrinking.

And “unamused” is rather uninformed about social security funding

It’s one thing to have different opinions, but if you allow people to make up their own facts, and your moderators post these comments … it effects your credibility.

You worked hard not to be a blog for miseducated tin foil hat crowd. Keep them away or else you wasted your time

And “unamused” is rather uninformed about social security funding

Really? In what way?

Speak up, man. Give it your best shot. Don’t hold back. Tell us the truth, if you have any.

Second time in a week I’ve been attacked by name with mere innuendo. Still no death threats though, but I’d expect those to have been deleted.

One more is a Hat Trick!

Una,

Well, for one, there is no trust fund, no dedicated pool of productive assets – just a sh*t ton of claims against the gvt – which can only be made good by higher taxation or even faster money printing.

SS has always been a Ponzi based on faster population growth and increasing incomes – SS has been known to be in for Boomer retirement problems for *decades*.

And the problems (stagnant or declining income and resultant population stagnation) of the last 20 yrs has only made it worse.

Cas127 and Yak now,

Here are some hard facts and charts about the SS trust fund. Make sure you read it:

https://wolfstreet.com/2019/10/13/social-security-trust-fund-recovers-a-tad-in-fiscal-2019-interest-rate-earned-sinks-to-record-low/

Yak now,

My understanding is that IL is losing population. I haven’t checked NY and CT. But I live in CA and I watch this down to the millimeter here because it’s a huge issue here. And CA is NOT losing population yet.

There is a lot of domestic out-migration, as you know, but the domestic in-and-out-migration numbers that you see everywhere — such as the U-Haul index, etc. — don’t show the international in-migration.

CA is a gateway state, so there is still a large influx (a big part from Asia). So in net numbers, domestic and international, CA is still growing. But the growth is slowing down, and the fear is that the international in-migration, particularly from Asia, will slow down, and that CA might go the way of IL and lose population. This is a real possibility, but it hasn’t gotten there yet, though we’re getting closer.

The census bureau is predicting CA and IL will lose seats in the House of Representatives.

And Texans are bluntly telling you and yours to stay away

CT has been losing population for at least ten years. Many sources, from U-Haul to the State of CT statistics report this. With an aging population, the cold weather does not make it a fun place in winter. For blue collar and middle class workers, it has been home to shrinking opportunities for a long time. Yes, the taxes are higher, along with utilities and other expenses, so retirees leave. I lived there for 65 years, left in 2013. I looked at the Raleigh-Durham area, but decided on Qingdao, China. NC is still a good choice for retirees.

Very true what you wrote about Ct, I have friends there who have left for all those reasons You are also correct about Raleigh/ Durham I sold my house in NY Long Island and looked for a place there for.a couple months however found it nice but alittle generic for my taste and my wife and I decided , like you to go overseas and we returned to her native Turkey where life so far has been wonderful I hope it stays that way

Roddy,

That would be an interesting story, on why you decided on Qungdao China. That is very out of the box thinking, and if you ever decided to enlighten us, it will be a story worth reading I’m sure.

Roddy,

I agree with Greg’s assessment that it “would be an interesting story, on why you decided on Qungdao China.” I assume this story would be too long for the comments. If interested in telling the story, contact me by email.

When I lived in the west (decades in AZ and CA), the govt often said they didn’t know how many illegal immigrants were in the US.

You have to be careful about these numbers now because they often only consider legally/documented people.

At one point it was widely said by the govt authorities that they believed that the number that were caught/involved with law enforcement for immigration status was less than half of all the people in the country illegally.(!)

CSX long term debt increases from 10.962B in 2016 to 15.992B 3rd Q 2019. Exchanging shares for debt benefits who? Railroads were also richly rewarded by 2017 tax reform. What did labor get out of that as promised by your Republican Gov?

I believe that unamused really needs a job! With that said:

I am certainly no fan of big corps. who basically pay for campaigns, etc. and by doing so comprise so may politicians.

I am no fan of so called right wing.

I am no fan of so called left wing.

So, get a job and go to bed.

How the heck did a conversation about CSX performance (or lack thereof) goosed by stock buybacks turn to an argument between commenters.

Guys, the message was loud and clear. Buybacks drives everyone crazy.

Iamafan,

You’re so right. I just went through my second wave of slash-and-burn in this thread, deleting countless comments by numerous commenters who had gotten into increasingly nasty arguments over three topics that were totally unrelated to railroads and that derailed, so to speak, this comment thread.

I almost never do this.

Folks please review the commenting guidelines:

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

Legal immigrants pay more.

I don’t think illegal immigrants pay ss as they del with cash

I know one Government employee (higher up in GS), will not get SS when he retired. I asked him why. Because, in those days he can opt out of SS. Anyway he is rich and got .gov pension. I also heard teachers in some states are not eligible for SS because they contribute to teachers retirement plan. Legal immigrants and H1b visa holders do not have a choice. They MUST pay into the SS.

I heard that, during Bill Clinton years (politics aside) SS had surplus (Treasury also). SS lend money to the budget (invested in treasury bonds). Rates are very low now. What will happen if the negative rates policy is implemented in future? SS will be a net loser. Like lot of us here, now SS worry about the return on the investment. The worst case scenario will be the loss of the investment altogether.

Bingo Illegal immigrants like the ten or so that work for my ex boss pay zero in taxes or SS payments and some of them collect goodies like foodstamps and use emergency rooms for their primary medical care Don’t want this to devolve into an immigration debate though

Those are the talking points of a Xenophobe. You and “sharp cookie” Petunia appear to be cut from the same cloth. I would be willing to bet my entire net worth that the economic impacts of illegals doing whatever it is you are saying they are doing is absolutely miniscule compared to the much, much bigger frauds that legals are commiting.

Also your ex boss is breaking the law by hiring illegals and is the actual source of this problem, so go complain to him, not us.

The last sentence is the most revealing one:

“Even while revenues fell 3% for the year, and 8% in the quarter, and while headcount was being cut by 7% in the year, and other things were trimmed and whittled down, CSX blew $3.4 billion in 2019 on buying back its own shares – which exceeded its after-tax income of $3.33 billion.”

IOW, they spent every single dollar of their income, AND borrowed a relatively sum of about $7 million, to buy back shares.

The only thing that they have to show for an entire year of effort is a higher stock price. They didn’t re-invest profits in the business, but rather de-invested several million dollars – admittedly, a small sum in the context of billions – from their own business.

Less revenue – down 3%.

Fewer employees – down 7%.

Fewer shares – reduced by $3.4 billion of buybacks.

Shrinking your business to inflate the value of your stock options is the current paradigm for CEOs.

Every big American business seems to be slowly eliminating itself to “maximize shareholder value”.

Thus we have empty malls, empty railyards, emptying cities, emptying states, and a total fertility rate of 1.7655 kids per woman, which is 16% below the replacement level of 2.1 needed to have zero population growth.

https://www.cdc.gov/nchs/data/nvsr/nvsr68/nvsr68_01-508.pdf

This data is from 2017, and the trendline was for the total fertility rate to drop by 2 or 3% a year in the 2010s, so it’s most likely below 1.7 by now.

Our “values” are screwed up, as our society values stock buybacks more than motherhood these days.

Typo – $3,330 million in income minus $3,400 million in buybacks is about negative $70 million, not $7 million.

It’s still small in the context of billions of dollars, and since the buybacks are rounded off to the nearest $100 million, it’s probably not exactly $70 million anyway.

Said in a different way, are there anymore places to put your money when Treasuries only yield 1.5% and foreign ones are negative and there’s all this talk of low inflation forever?

Buybacks make the companies look good for a while. Then what? Debt default?

This has obviously been forgotten! “If about 5% of the comments under one article are yours, it’s time to back off. So if the article has 80 comments and 4 are yours, it’s time to slow down.”

Twelve out of forty six comments by the same person is a tad bit over and makes the comment section unbearable to read through!

Unamused is the most frequent commenter on many articles

One learns which commenters to skim and which to read carefully.

If wolf doesn’t accept official numbers from social security administration, and doesn’t accept early but official census numbers… it brings every post he writes into doubt.

Clearly this is just another San Francisco political blog

Yak now,

This fearmongering about SS is nuts. READ THIS — yes the official numbers from SSA, including charts:

https://wolfstreet.com/2019/10/13/social-security-trust-fund-recovers-a-tad-in-fiscal-2019-interest-rate-earned-sinks-to-record-low/

I searched for “early official census numbers” and found nothing. Please post a link to whatever source you think you have for this.

David Rosenberg:

there is only a 7% correlation between GDP and the S&P 500. Historically, in any given cycle that relationship was anywhere between 30% and 70%.

He said that the market is basically mostly goosed by buybacks fueled by low interest and liquidity by the Fed together with the gush of European and Japanese money running away from negative rates.

I will encourage all of you to watch him, Gundlach, Bianco, di Martino Booth plus others in the second part of the doubleline roundtable available in YouTube. They explain why the markets are crazy.

I’m surprised that Rosenberg finds it is even as high as 7%.

Total stock market capitalization has been growing 15 TIMES faster than GDP over the past 13 month – and counting. This is surreal and should be scaring the beejeezus out of people.

Isn’t total stock market capitalization a function of the Fed’s growing balance sheet. I believe I have seen a graph correlating the two on ZeroHedge (for what it’s worth).

Another load of cobblers. Read what Wolf posted for the truth. As we can see here, certain ‘groups’ are hard at work, doing their best to destroy the U.S. gov. There is so much disinfo in this thread concerning SSI it makes me laugh.

As having paid in SSI myself over 45 years and now receiving back I certainly don’t feel ‘fleeced.’ It’s a lifesaver actually. As for ‘welfare, just look to the Fed and Wall St. And your fav politicians. They are the only ones benefiting from all the ‘givaways. Now go back are read Wolf’s link.

Thank you, Norma Lacy, thank you.

And here’s Your short comment: Where do you get off telling people they won’t be receiving their SSI? I’m pretty sure Norma has been receiving hers. I myself sure haven’t missed a payment in years. You should be ashamed of yourself.

1) Apples are healthier than Coke. The Dec/ Jan period is the apples season.

2) Shorting stocks is treason. Selling Wells Fargo B&H forever

is not. Nothing last forever if it must be done. Berkshire imaged in Wells Fargo face recognition. WFC might take BRK to the cleaners, like in 2008/09. At top of the cliff there is always too much risk. 3) Warren Buffett love fresh apples. In Sept/Nov 2018 AAPL : SPX popup, then ==> AAPL dived like an eagle to hunt a rabbit, in the cold valley down below, feasting during Dec/ Jan, wouldn’t let go until he accumulated enough AAPL stocks, while SPX made a high jump in short covering.

4) Using the warm thermal air, the eagle lifted himself up above

the highest cliff, dropped Wells Fargo in a waterfall collapse.

Michael Engel I like your comments. I don’t understand them alot of the time but they are fun to read.

They are pretty cryptic. 1) Apple phones are just like Cocaine

Mineral: +6%

Metals and equipment: -6%

This is clearly fracking at work, or to be more precise the last advances in fracking at work.

“Footprint minimization” means energy companies can now drill multiple wells from a single pad. The amount of heavy equipment (diesel engines, pumps, motorized winches etc) is decreasing, albeit it is still enormous.

At the same time the growing number of wells drilled requires more and more “frac sand” even if the quantity needed for each well is slowly decreasing: in spite of the name frac sand is usually high purity sandstone crushed to a very uniform size. There is only a small number of plants in the US that can crush sandstone into frac sand, meaning sandstone is shipped to the plants from quarries and from there to shale fields. More work for CSX, albeit hauling sandstone around doesn’t pay as well as industrial diesel engines and brand new cars.

Chemicals: -4%

Fracking consumes an enormous amount of chemical products, but energy companies have been under pressure to cut usage, partly because of pollution concerns and partly because, well, some of the stuff they use is becoming more expensive and eats into margins (so much for the “no inflation” myth). For example guar gum as been largely replaced by cheaper hydroxyethyl cellulose as a thickening agent, but as demand soared (and costs increased) the pressure is to use as little of it as technically possible. Same as with everything else, from citric acid (used to prevent precipitation of iron oxides) to polyacrylammide (friction reducer).

But still chemicals traffic is a sign that industrial activity throughout the US is slowing down, something that was to be expected after the 2016-8 insanity. I don’t think there will be a recession, but after the November elections all bets are off the table, especially in the real estate sector.

Fracking has been described as going to a bar and instead of being able to order a pint of beer, you get a straw and you suck the dregs out of the carpet.

Simon Michaux, an Aussie mining engineer/professor, explains who a similar scenario is playing out with respect to mining.

When you need 100 truckloads of ore to get the same amount of copper as you once got from 10 truckloads, then obviously the cost of anything involving copper MUST increase significantly.

We picked the low hanging resource fruit. Now we are paying the price of having only the high-hanging, expensive to pick stuff.

And that is why prosperity is vapourizing for so many.

Petunia is one sharp cookie She writes more honest truths than anyone else on this site

I’m with Norma on this I never collected a single penny in unemployment insurance, or welfare of any kind in 45 years of working and I feel fully entitled to what I paid in now that I’m retired Never collected 5 cents in claims on 45 years of homeowner premiums either unlike lots of crooks around me Call me old fashioned or OK Boomer I could care less

There are a bunch of oil pipelines coming on line over the next couple of years which I would expect will lower the oil by rail traffic. This should make the environmentalists happy (but it won’t) since the environmental footprint of pipeline vs rail is so much less. Keystone will be especially welcome since a lot of heavy oil from Canada’s oil sands is moved to the Gulf Refineries via rail which I believe is over 2000 miles.

No Stan,

Remember this statistic on SS pool borrowing by Govt : “every cent that’s been borrowed by the federal government via its special-issue bonds is accounted for. Not only that, but these bonds bore an average interest rate of 2.85% as of the end of 2018. ”

Whenever the finger pointing starts about a shrinking pie, the worker, immigrant, or minority gets demonised. Now, it’s the senior. How often do we hear about ‘trimming the fat’ when the other guy loses his job? But when it’s you, its a goddamn criminal shame. I read in the above comments someone actually had the nerve to suggest all those laid off rail workers can just go find work building some of those unaffordable houses. No, just go find a new job like all the other working stiffs out there.

Meanwhile, all manner of pretty modest helping hands programs get lumped into the demon pool, from a hot lunch for poor school kids, to disability cuts, and the imposition of work for food stamps which will cost more to administer than it will save. And the SS fund is raided (excuse me…borrowed from) to help pay for everything Govt.

Those seniors, expecting a pension. Imagine!!

And Chris Collins is going to jail for 26 months for insider trading, Trumpy has OJ’s lawyer and Clinton’s prosecutors in his defense corner while his children run his/their business empire. No one has seen the tax returns and you blame seniors for the demise of Social Security.

Talk about entitlements.

The cost of the ONE surveillance drone shot down by Iran? 220 million smackeroos.

“According to a Congressional Budget Office (CBO) report published in October 2007, the US wars in Iraq and Afghanistan could cost taxpayers a total of $2.4 trillion by 2017 including interest.” (About the same amount in the SS investment pool that funds SS benefits to 2034) hmmm

“The average Social Security retirement benefit paid to a retired worker is $1,413 per month as of June 2018. However, your initial monthly benefit could be much greater or much less than that amount, depending on your age and income.Aug 21, 2018”

“Additionally, every cent that’s been borrowed by the federal government via its special-issue bonds is accounted for. Not only that, but these bonds bore an average interest rate of 2.85% as of the end of 2018. ”

Wait a minute??!! Could this be the problem? Low interest rates and low returns? But the stock market is up. Buybacks are up! The economy is booming, right?

As of 2013, the top 1% of households owned 38% of stock market wealth. As of 2013, the top 10% own 81% of stock wealth, the next 10% (80th to 90th percentile) own 11% and the bottom 80% own 8%.

The railroads going under? What? From the article: “Even while revenues fell 3% for the year, and 8% in the quarter, and while headcount was being cut by 7% in the year, and other things were trimmed and whittled down, CSX blew $3.4 billion in 2019 on buying back its own shares – which exceeded its after-tax income of $3.33 billion.”

Talk about entitlements. Ain’t capitalism grand?

I urge some of you above to review Wolfe’s commenting guidelines and shape up. You’re getting old.

Arctic cold slowed down R/R tankers traffic moving oil sands from

Canada to US, increasing inventory even higher, lifting the gap

between WTI & WCS.

It was too cold in Alberta even for Canadians.

Not sure about oil sands issue, but in general terms, the AAR reported that car loads of petroleum and petroleum products increased 1.6% in December year-over-year, one of the few categories to book an increase.

I agree Van makes good points most of the time buy categorizing social security was welfare is pretty far off the mark.

buy -> but

was welfare -> as welfare

edit button please

Even a significantly reduced 2.4 million dollar windfall is a heck of a lot. All for doing nothing other than ‘being there first’.

If they had been extracting equity from the house via refi over the years then they still got their free 2.4 million, just some of it they got spread out over the years previous.

Also if they lived in Santa Clara for 40 years, they have been *significantly* underpaying on property taxes for decades. Any taxes they had to pay on their windfall are unlikely to have even come close to balancing that out.

It is very, very unlikely that our friends were hard done by in any way in this transaction, despite the implication of your last sentence.

“our friends” -> “your friends”

Sorry for the typos, I have a band aid on my finger from a cooking snafu and it’s causing typos. I really should proofread my comments fully before hitting “Post Comment” but I am too lazy. That being said, a comments system without an edit button is unnecessarily frustrating.

Illegals are in the lower paid strata though. Hard to believe that anyone in that strata is going to be able to save significantly even if their income is slightly inflated by not paying taxes.

Legals in the lower paid strata pay very little taxes also, for what it’s worth.

Ron, similar situation for me when I sold my Sunnyvale home of 23 years. SS checks were reduced for one year, not by cutting my benefit but by increasing my monthly medicare deduction.

These comapnies are all “LBO’ing” themselves. Their balance sheets are so highly leveraged that they have negative book values. If the next recession is anything but short and shallow, they will ALL be going bankrupt – roughly at the same time.

let’s not mince words the economy is in recession. the ISM index has been in contraction since August 2019. Retail sales were down in real terms in q4 of 2019. this means retail companies are not going to order any merchandise that is not being sold, and manufacturers are not going to produce anything that is not ordered.

“Corporation don’t pay taxes, people do.”

Right. The money saved from the cuts and don’t use for compensations and stock buy backs will trickle right down to the consumer.

Witness all the services and products that have dropped in price the last 3 years….(see any?)

Sunday AM.. Just skimmed thru the comments, after reading the article. Wowza.. There are some misinformed people out there. Wolf… Do not think you are a political blog at all.. Thanks for what you do…..

The fads of the now in railroading are a) hedge fund ownership and, b) “precision scheduled railroading” which is a bit of buzzwordization meaning running freight trains on a schedule (like nobody ever thought of that before).

The name yr looking for here is Hunter Harrison, ex-CP exec who was given the CEO post of CSX by owner Mantle Ridge LP.

//CSX said it plans to ask shareholders to vote on aspects of Harrison’s compensation package that would include reimbursing him for $84 million in compensation he forfeited at CP. Harrison says he will resign if the compensation isn’t approved.

Harrison will also get options on nine million CSX shares.//

Harrison died @ the end of 2017; choked on his own success. His replacement, Joe Nobody, is following in Harrison’s ‘looting the company while calling it innovation’ footsteps.

The four major US railroads have non-railroad management (including BNSF if Berkshire-Hathaway is thought of as a hedge fund). The model followed for hedge fund ownership is Eddie Lampert.

https://angrybearblog.com/2018/11/csx-slowly-being-dissembled-by-mantle-ridge-hedge-fund.html

Railroads have abandoned routes, alienated customers, slash-and-burned employees, mothballed locomotives, closed freight yards and basically cut everything except the most lucrative services while borrowing big to repurchase shares.

Oh yeah, repurchase shares:

//Paul Hilal’s investment vehicle, Mantle Ridge LP, has sold off nearly all of its $1 billion position in CSX, according to securities filings. About 4.7 million shares were bought back by the railroad.//

https://www.marketwatch.com/story/activist-investor-that-shook-up-csx-sells-most-of-its-stake-2019-10-21

Meanwhile:

//Great Job, but terrible work environment

Written by Machinist (Current Employee) from Waycross, GA on January 15, 2020

Was once a great place to work, but since the buyout by a hedge fund, profits are the only concern of management. Safety and a friendly work environment have suffered greatly.//

What percentage of CSX C-suite compensation over the last 5 years came from options exercise? At most public firms with large buyback programs, much of the buying is simply to offset dilution from options issuance. As a result, there are THOUSANDS of executives in the U.S. who have seen their net worth move into the $20 million – $30 million range. This is NOT how the system is supposed to work – there is NO real risk here.