- News

- City News

- ahmedabad News

- Nirmala Sitharaman: Talks on with PMO on economic remedial steps in Ahmedabad

Trending

This story is from August 17, 2019

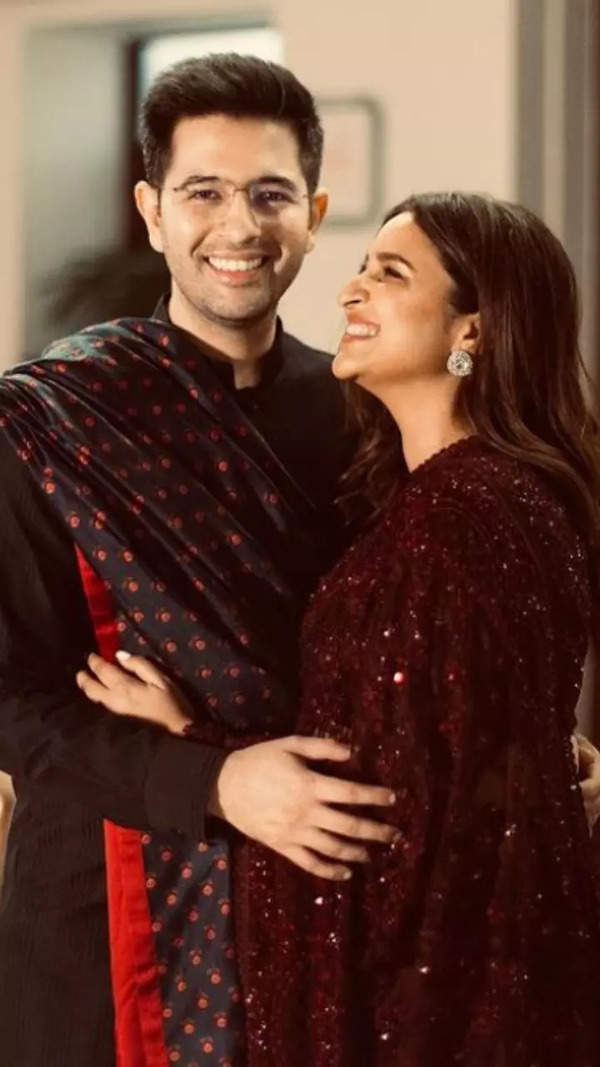

Nirmala Sitharaman: Talks on with PMO on economic remedial steps in Ahmedabad

Discussions are being held between the Prime Minister’s Office (PMO) and the Union finance ministry about remedial measures for the economy, Union finance minister Nirmala Sitharaman said on Friday, during a media interaction at the Ahmedabad circuit house

Nirmala Sitharaman

AHMEDABAD: Discussions are being held between the Prime Minister’s Office (PMO) and the Union finance ministry about remedial measures for the economy, Union finance minister Nirmala Sitharaman said on Friday, during a media interaction at the Ahmedabad circuit house.

Sitharaman said, “I have met five groups since last Monday, including banks, industries, SMEs, the financial sector and the automobile sector.We are analysing what is to be done and how. A meeting was held with the Prime Minister on Thursday and we will soon respond.”

About a stimulus package and the representations made by industry, the minister said, “I would not like to link anything about the stimulus package with this. Each sector has discussed in detail. We have heard them out. Whenever the government is ready, an announcement will be made.”

Some of the issues raised were the liquidity crunch that every sector is reeling from, in addition to the issue of credit inflows to MSMEs and other sector-specific issues.

“An overly conservative approach by banks in extending credit is hurting industry, apart from the liquidity crunch that each sector is battling. Two major issues related to the textile sector that were discussed were the revoking of MEIS and its impact on the industry and that of rebate of state and central taxes and levies (ROSCTL),” said Chintan Thaker, co-chair of Assocham.

Industry bodies also sought relaxation in the norms classifying accounts as non-performing assets (NPAs). “We have suggested that NPA classification norms need to be eased especially for MSMEs. Banks must give priority to MSME funding, because currently they are reeling from a severe capital crunch. Moreover, banks are not passing on the repo rate reduction to borrowers.”

Sitharaman said, “I have met five groups since last Monday, including banks, industries, SMEs, the financial sector and the automobile sector.We are analysing what is to be done and how. A meeting was held with the Prime Minister on Thursday and we will soon respond.”

About a stimulus package and the representations made by industry, the minister said, “I would not like to link anything about the stimulus package with this. Each sector has discussed in detail. We have heard them out. Whenever the government is ready, an announcement will be made.”

State-level representatives of various industry bodies including the Gujarat Chamber of Commerce and Industry (GCCI), the Confederation of Indian Industry (CII), Federation of Indian Chambers of Commerce and Industry (FICCI) and Associated Chamber of Commerce and Industry (ASSOCHAM), had a 45-minute meeting with the minister.

Some of the issues raised were the liquidity crunch that every sector is reeling from, in addition to the issue of credit inflows to MSMEs and other sector-specific issues.

“An overly conservative approach by banks in extending credit is hurting industry, apart from the liquidity crunch that each sector is battling. Two major issues related to the textile sector that were discussed were the revoking of MEIS and its impact on the industry and that of rebate of state and central taxes and levies (ROSCTL),” said Chintan Thaker, co-chair of Assocham.

Industry bodies also sought relaxation in the norms classifying accounts as non-performing assets (NPAs). “We have suggested that NPA classification norms need to be eased especially for MSMEs. Banks must give priority to MSME funding, because currently they are reeling from a severe capital crunch. Moreover, banks are not passing on the repo rate reduction to borrowers.”

End of Article

FOLLOW US ON SOCIAL MEDIA