- News

- City News

- ahmedabad News

- Gujarat eyes Maharashtra model, to revise jantri rates every year

Trending

This story is from June 14, 2019

Gujarat eyes Maharashtra model, to revise jantri rates every year

The Gujarat government is finally set to revise its jantri — ready reckoner rates for collecting stamp duty on property

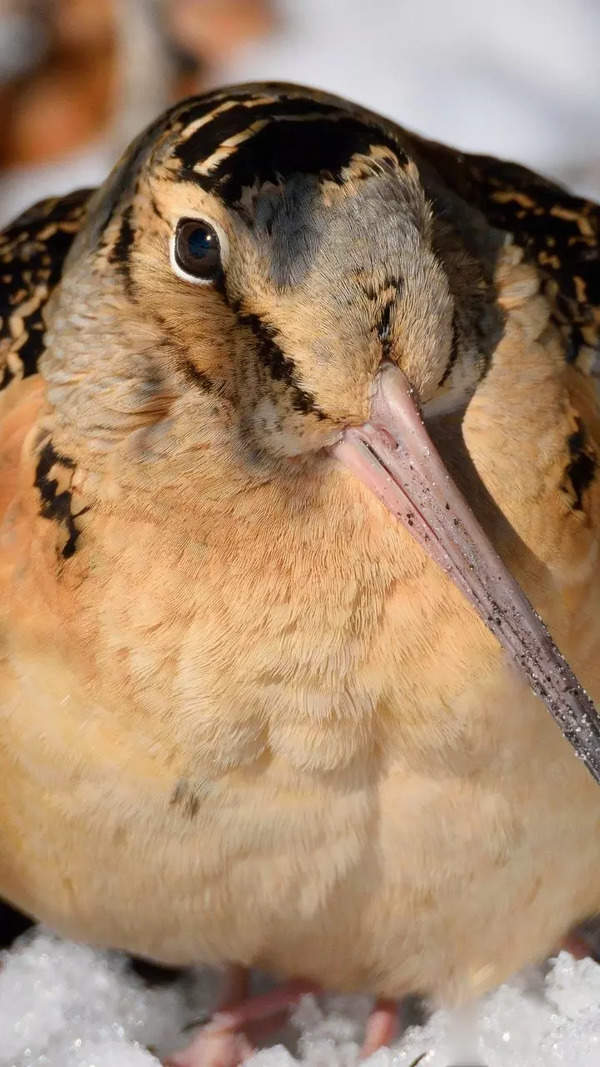

Jantri rates were hiked in Gujarat by almost 50% in February 2007 and stayed unchanged since 1999. The next rate revision took place in 2011

GANDHINAGAR: The Gujarat government is finally set to revise its jantri — ready reckoner rates for collecting stamp duty on property. This time, the state government is deliberating on adopting the ‘Maharashtra model’, where jantri rates are revised every year.

Unlike Gujarat, which revises its jantri rates once in nearly a decade, its fiercely competitive neighbouring state has an online e-Stamp Duty Ready Reckoner (RR) which helps calculate the “true market value” of any immovable property.

The Public Accounts Committee (PAC) of the state assembly had in 2016 suggested that jantri rates could be revised every year. While citing Maharashtra’s example, PAC had also recommended creation of an authority for citizens to appeal against irrationally high or low jantri rates.

“We hope to come out with a concrete formula after the monsoon session comes to an end in July end,” said a senior revenue department official closely linked to the process.

“Currently, the difference between jantri and actual market rates is 50% in rural areas and about 80% in major cities and towns in the state. There were deliberations to reduce this gap,” the revenue official added.

State revenue minister Kaushik Patel that his department plans to initiate the jantri revision process soon. “But our top priority is revising rates in areas with major discrepancies. We are yet to issue formal instructions to district authorities which will be done once the government reviews all possible implications.’’ The Comptroller & Auditor General (CAG) had made critical observations last year about the huge loss to the state exchequer due to discrepancies in calculation and implementation of the jantri rates of land. The CAG, in its most recent report submitted in March 2018, had said, “The government of Gujarat failed to apply Annual Statement of Rates from 2012 to 2017.”

Unlike Gujarat, which revises its jantri rates once in nearly a decade, its fiercely competitive neighbouring state has an online e-Stamp Duty Ready Reckoner (RR) which helps calculate the “true market value” of any immovable property.

The Public Accounts Committee (PAC) of the state assembly had in 2016 suggested that jantri rates could be revised every year. While citing Maharashtra’s example, PAC had also recommended creation of an authority for citizens to appeal against irrationally high or low jantri rates.

“We hope to come out with a concrete formula after the monsoon session comes to an end in July end,” said a senior revenue department official closely linked to the process.

“Our effort will be to significantly reduce the gap between the jantri and market rates and to be more realistic and scientific,” added the official. In Gujarat, the jantri rates were hiked by almost 50% in February 2007; the rates had been unchanged since 1999. The next rate revision took place in 2011.

“Currently, the difference between jantri and actual market rates is 50% in rural areas and about 80% in major cities and towns in the state. There were deliberations to reduce this gap,” the revenue official added.

State revenue minister Kaushik Patel that his department plans to initiate the jantri revision process soon. “But our top priority is revising rates in areas with major discrepancies. We are yet to issue formal instructions to district authorities which will be done once the government reviews all possible implications.’’ The Comptroller & Auditor General (CAG) had made critical observations last year about the huge loss to the state exchequer due to discrepancies in calculation and implementation of the jantri rates of land. The CAG, in its most recent report submitted in March 2018, had said, “The government of Gujarat failed to apply Annual Statement of Rates from 2012 to 2017.”

End of Article

FOLLOW US ON SOCIAL MEDIA