- News

- City News

- ahmedabad News

- Independence Day tidings: Taxpayers get Rs 350 crore relief in Ahmedabad

Trending

This story is from August 15, 2019

Independence Day tidings: Taxpayers get Rs 350 crore relief in Ahmedabad

The Ahmedabad bench of the Income Tax Appellate Tribunal (ITAT) on Wednesday disposed of 628 appeals filed by assessing officers, resulting in taxpayers getting relief for an estimated Rs 350 crore

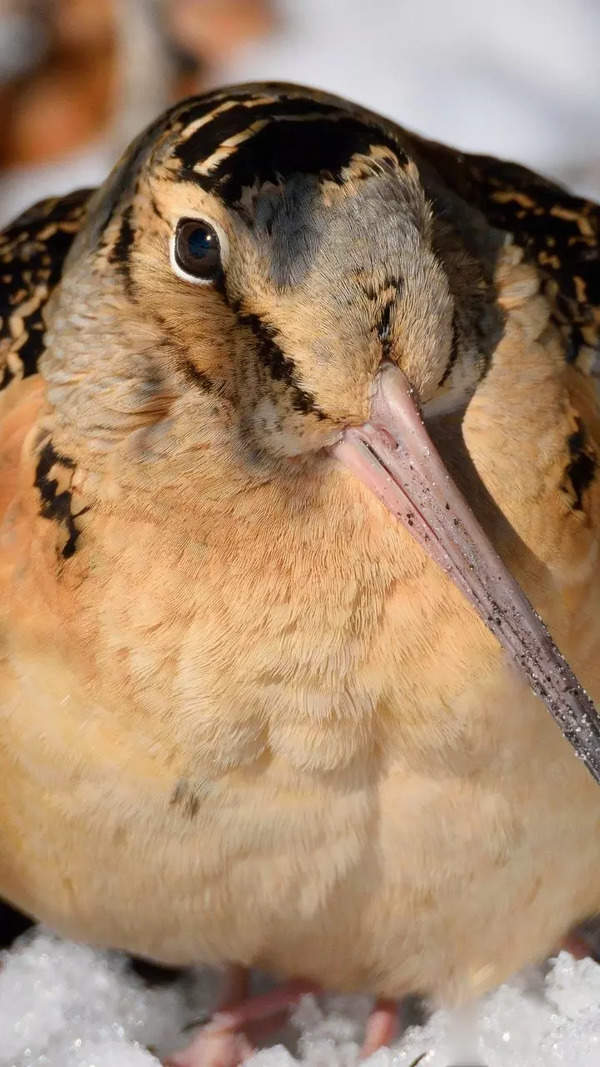

Picture used for representational purpose only

AHMEDABAD: The Ahmedabad bench of the Income Tax Appellate Tribunal (ITAT) on Wednesday disposed of 628 appeals filed by assessing officers, resulting in taxpayers getting relief for an estimated Rs 350 crore. These appeals were filed by the officers, questioning the tax relief granted by the commissioner of income tax (appeals).

The Ahmedabad bench’s decision to dismiss these appeals as withdrawn comes a few days after the Central Board of Direct Taxes (CBDT) on August 8, 2019, raised the threshold for filing of appeals by the income tax department with tax tribunals, high courts and the Supreme Court.

The Ahmedabad bench comprised of Justice P P Bhatt, president and Pramod Kumar, vice-president, ITAT.

According to the CBDT circular, the I-T department cannot file an appeal before the ITAT unless the “tax effect” is Rs 50 lakh. This limit was Rs 20 lakh earlier. The limits for appeals before the high courts and the Supreme Court are now Rs 1 crore and Rs 2 crore, respectively.

Relief of up to Rs 1 crore granted by the tribunal cannot be challenged in the HC and similarly, that of up to Rs 2 crore by the HC cannot be challenged in the SC.

The limit for appeals before the tribunals has been increased by around 1,600% from Rs 3 lakh in 2014. “This substantial relaxation is certainly a huge step signifying the trust placed by the government of India in decisions of appellate forums and substantially cuts down time taken in the finality of the appeals process,” Justice Bhatt added.

The ITAT described the relaxation as “freedom from prolonged agony and uncertainty of litigation to so many taxpayers on the eve of this Independence Day”. The lead case before the tribunal was an appeal filed more than 15 years ago and the assessment year pertained to more a period more than 20 years ago.

It is estimated that some 5,000 such appeals are pending in the ITAT all over the country and the tax relief involved is to the tune of Rs 2,500 crore. The process of identifying and disposing of these appeals is under way at all stations.

So far as Ahmedabad zone is concerned, rather than waiting for the litigants to point it out, the ITAT proactively scrutinized the pending appeals and identified these appeals for disposal.

“This is a commendable step. The speed and spirit with which the tribunal has passed this order is indeed praise worthy,” said Mukesh Patel, a leading advocate and member of the taskforce for rewriting of the Income Tax Act.

“This (raising the threshold limit) shows the government’s intent to reduce litigation and become taxpayer friendly,” added A D Mehrotra, principal chief commissioner of income tax, Gujarat.

The Ahmedabad bench’s decision to dismiss these appeals as withdrawn comes a few days after the Central Board of Direct Taxes (CBDT) on August 8, 2019, raised the threshold for filing of appeals by the income tax department with tax tribunals, high courts and the Supreme Court.

The Ahmedabad bench comprised of Justice P P Bhatt, president and Pramod Kumar, vice-president, ITAT.

According to the CBDT circular, the I-T department cannot file an appeal before the ITAT unless the “tax effect” is Rs 50 lakh. This limit was Rs 20 lakh earlier. The limits for appeals before the high courts and the Supreme Court are now Rs 1 crore and Rs 2 crore, respectively.

“What this is that when a commissioner (appeals) gives the taxpayer relief of up to Rs 50 lakh in an appeal in an assessment year, the matter ends there and relief so granted can’t be challenged before this tribunal,” Justice Bhatt said in the order disposing of the appeals.

Relief of up to Rs 1 crore granted by the tribunal cannot be challenged in the HC and similarly, that of up to Rs 2 crore by the HC cannot be challenged in the SC.

The limit for appeals before the tribunals has been increased by around 1,600% from Rs 3 lakh in 2014. “This substantial relaxation is certainly a huge step signifying the trust placed by the government of India in decisions of appellate forums and substantially cuts down time taken in the finality of the appeals process,” Justice Bhatt added.

The ITAT described the relaxation as “freedom from prolonged agony and uncertainty of litigation to so many taxpayers on the eve of this Independence Day”. The lead case before the tribunal was an appeal filed more than 15 years ago and the assessment year pertained to more a period more than 20 years ago.

It is estimated that some 5,000 such appeals are pending in the ITAT all over the country and the tax relief involved is to the tune of Rs 2,500 crore. The process of identifying and disposing of these appeals is under way at all stations.

So far as Ahmedabad zone is concerned, rather than waiting for the litigants to point it out, the ITAT proactively scrutinized the pending appeals and identified these appeals for disposal.

“This is a commendable step. The speed and spirit with which the tribunal has passed this order is indeed praise worthy,” said Mukesh Patel, a leading advocate and member of the taskforce for rewriting of the Income Tax Act.

“This (raising the threshold limit) shows the government’s intent to reduce litigation and become taxpayer friendly,” added A D Mehrotra, principal chief commissioner of income tax, Gujarat.

End of Article

FOLLOW US ON SOCIAL MEDIA