Trending

This story is from August 19, 2019

Maharashtra: Even in drought year, premiums more than insurance payouts to farmers

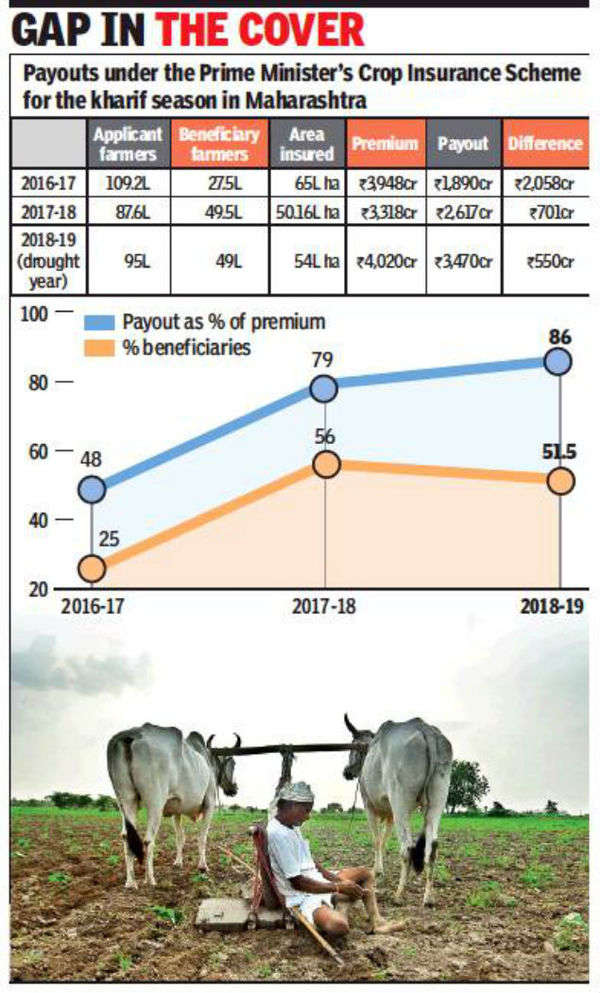

Premium paid to insurance companies has outstripped compensation to farmers during the kharif season in all three years of the Prime Ministers Crop Insurance scheme (PMFBY) in Maharashtra, latest data shows. This was true even for 2018-19—a drought year with over 40% of the state’s talukas affected by a water crisis.

The number of farmers compensated for the 2018-19 kharif season is 49 lakh, almost on par with 49.5 lakh who got compensation for crop losses in the same period of the previous year

MUMBAI: Premium paid to insurance companies has outstripped compensation to farmers during the kharif season in all three years of the Prime Ministers Crop Insurance scheme (PMFBY) in Maharashtra, latest data shows. This was true even for 2018-19—a drought year with over 40% of the state’s talukas affected by a water crisis.

Premium paid to insurance companies in kharif season over the past three years totalled Rs 11,286 crore while compensation paid to farmers for crop losses was Rs 7,977 crore.This is a difference of Rs 3,309 crore. Kharif, sown during monsoon, is the main crop in Maharashtra. In the kharif season of the drought year of 2018-19, there was a gap of Rs 550 crore between the premium paid to insurance companies and payout to farmers. Premium paid to insurance companies was Rs 4,020 crore and compensation paid to farmers Rs 3,470 crore.

The number of farmers compensated for the 2018-19 kharif season is 49 lakh, almost on par with 49.5 lakh who got compensation for crop losses in the same period of the previous year. Only 51.5% of the farmers who applied for crop insurance were compensated for the ’ 18-19 kharif season.

Critics such as Marathwada-based activist Rajan Kshirsagar, though, say the very design of the scheme goes against farmer interests. “Insurance companies are getting huge premiums from the government but the bulk of insurance claims from farmers are rejected,” he alleged.

The scheme follows an area-based approach, and the unit considered in the state is a revenue circle. “In order to qualify for compensation, the farmer will have to report a yield which is less than the average yield of the revenue circle. So, if an individual farmer has suffered losses but the yield of a revenue circle is high, it is difficult for him to get compensation,” said Kshirsagar.

Officials say both the state and insurers take a higher risk under the PMFBY. “In the earlier National Agriculture Insurance Scheme (NAIS), the insurance company’s liability was capped at the amount of premium. Under PMFBY, the payout is capped at 350% of premium,” said one. Under NAIS, a farmer paid the premium. Under PMFBY, a farmer pays 1.5% of the sum insured for kharif crop and 2% for rabi. The remaining premium is equally divided between the Centre and the state. Officials say premiums are bound to be higher than payouts in a good year. “After all, insurance payouts will be high only when there is crop loss.”

Meanwhile, a public sector insurance company official said crop insurance is in the nature of a catastrophe cover. A period of a year or two cannot be used to determine the experience. “Premium has been scientifically calculated taking into account possibility of crop failure and its impact. When there are claims, they occur across a whole region. As these are low-frequency events, claims cannot be revised annually.”

Premium paid to insurance companies in kharif season over the past three years totalled Rs 11,286 crore while compensation paid to farmers for crop losses was Rs 7,977 crore.This is a difference of Rs 3,309 crore. Kharif, sown during monsoon, is the main crop in Maharashtra. In the kharif season of the drought year of 2018-19, there was a gap of Rs 550 crore between the premium paid to insurance companies and payout to farmers. Premium paid to insurance companies was Rs 4,020 crore and compensation paid to farmers Rs 3,470 crore.

The number of farmers compensated for the 2018-19 kharif season is 49 lakh, almost on par with 49.5 lakh who got compensation for crop losses in the same period of the previous year. Only 51.5% of the farmers who applied for crop insurance were compensated for the ’ 18-19 kharif season.

Officials, though, say the state has fared well under PMFBY. “Although there was a drought in 2018-19, the rabi season was affected much more than kharif. During the kharif season, both sowing and productivity were high. Those who suffered crop losses received insurance,” said state agriculture secretary Eknath Davale. He said the percentage of compensation paid to farmers as a share of premiums has improved post the scheme’s 2016 launch.

Critics such as Marathwada-based activist Rajan Kshirsagar, though, say the very design of the scheme goes against farmer interests. “Insurance companies are getting huge premiums from the government but the bulk of insurance claims from farmers are rejected,” he alleged.

The scheme follows an area-based approach, and the unit considered in the state is a revenue circle. “In order to qualify for compensation, the farmer will have to report a yield which is less than the average yield of the revenue circle. So, if an individual farmer has suffered losses but the yield of a revenue circle is high, it is difficult for him to get compensation,” said Kshirsagar.

Officials say both the state and insurers take a higher risk under the PMFBY. “In the earlier National Agriculture Insurance Scheme (NAIS), the insurance company’s liability was capped at the amount of premium. Under PMFBY, the payout is capped at 350% of premium,” said one. Under NAIS, a farmer paid the premium. Under PMFBY, a farmer pays 1.5% of the sum insured for kharif crop and 2% for rabi. The remaining premium is equally divided between the Centre and the state. Officials say premiums are bound to be higher than payouts in a good year. “After all, insurance payouts will be high only when there is crop loss.”

Meanwhile, a public sector insurance company official said crop insurance is in the nature of a catastrophe cover. A period of a year or two cannot be used to determine the experience. “Premium has been scientifically calculated taking into account possibility of crop failure and its impact. When there are claims, they occur across a whole region. As these are low-frequency events, claims cannot be revised annually.”

End of Article

FOLLOW US ON SOCIAL MEDIA