CHICAGO — As Illinois prepares to decide whether to change its tax structure to a graduated income tax, imposing higher taxes on higher earners, many are concerned about the potential impact.

Some say a so-called “Fair Tax” would help fix the state’s budget mess, but others caution it would have a negative effect by causing wealthy Illinois residents to leave the state.

But University of Chicago Professor Roger Myerson says framing the debate around the idea that higher taxes would make people leave doesn’t think the issue through all the way.

“They say taxes are going to want to make people leave the state and they just sort of stop there, and don’t think where it’s going to go next,” Myerson said.

Right now, the state’s “flat” tax, which charges every taxpayer at the same rate regardless of their income level, is written into the constitution.

Illinois voters will decide whether or not to change the state constitution when they consider the so-called “Fair Tax” referendum on the 2020 ballot.

Myerson’s thoughts on the topic are worth knowing, as he’s considered one of the world’s leading authorities on tax structures and won the Nobel Prize in Economics in 2007.

“Higher taxes are not going to drive businesses out of the state, what they’re going to do ultimately is affect land values,” Myerson said.

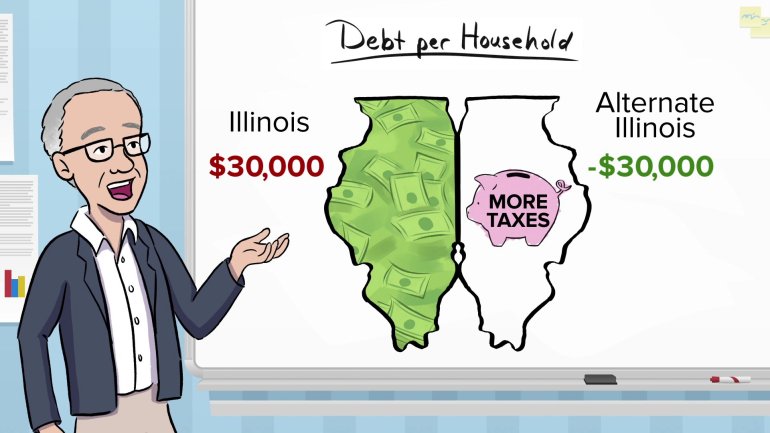

Illinois owes roughly $132 billion in unpaid pension debt, which divides into less than $30,000 per household. Myerson calls this amount the, “hidden mortgage, hidden debt that politicians didn’t tell us about because they weren’t taxing us.”

Does that mean property is worth less? Myerson says the “hidden mortgage” does lower home values in Illinois as people consider where to live.

But to calculate its larger impact, you need to do more than just compare the tax burden of Illinois to a neighboring state like Indiana, Myerson said.

To determine whether or not the state is better or worse off because of this unpaid obligation, Myerson said you need to compare it to a hypothetical Illinois where everyone has been paying more taxes over the last 30 years.

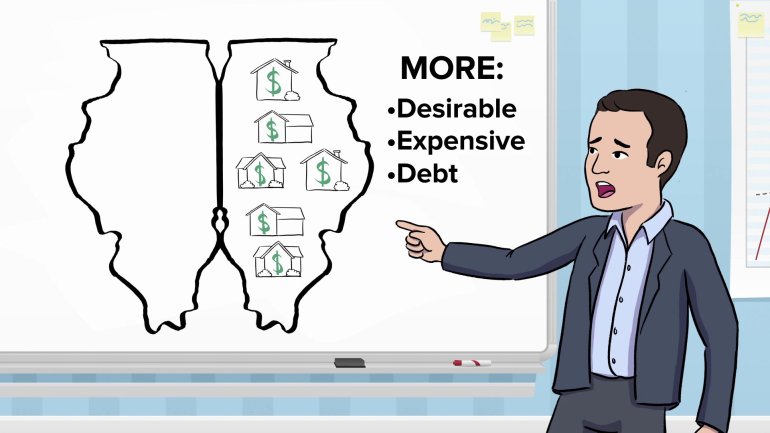

This would mean that the future tax bills for each household would be less, on average. But as a result, the state would become more desirable and housing would become more expensive. And homeowners would need to take on more debt to buy a house.

“That debt, in equilibrium, as we say in economic analysis, would be of the same order of magnitude as the tax debt that you’d be escaping by moving over there [to the other Illinois],” Myerson said.

Myerson says his point is the new tax structure will likely have the biggest impact on property, not population.

“Of course there is some cost to having to pay more taxes, that’s true. But, it’s not going to ruin the state of Illinois,” Myerson said. “What is more ruinous to Illinois is the systematic unwillingness to face the realities of budgeting, and accumulating debts that will just increase the burden in the future.”