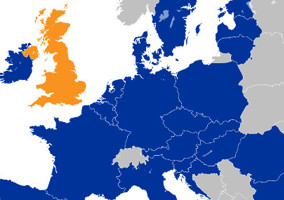

A potential positive outcome of Brexit could be that the European Union “takes aim” at the City of London and tries to reduce its damaging impacts on the global economy, a development expert said yesterday.

Jesse Griffiths, head of programmes at the Overseas Development Institute, was taking part in a panel debate at the Bond Conference titled ‘Life after Brexit’. He aimed to set out the impact of Brexit on the global economic system and how it might make things better or worse for developing countries.

Griffiths began by saying that many things will stay the same after Brexit for the role of UK NGOs trying to influence the global financial system, because the UK has its own seat at the table at almost all the international institutions, including the International Monetary Fund, the OECD, and at 25 of the 26 multi-lateral development banks.

“There is a huge variety of different organisations that help to set the rules for the global economy and have massive implications for developing countries, through which the UK will continue to influence through its own position, its own seat,” he said.

“The UK will also continue to be a member of the G20 and the G7, so if you think about where the UK operates through the EU in this sphere, it’s relatively rare. The biggest is the World Trade Organisation but quite a lot won’t change, the UK still has an outsized role in many of the bodies that set the rules for the global economy.”

He added that as a 0.7 per cent donor, the Department for International Development (DfID) is still a “big, influential player and will continue to be, whether in or out of the EU, so there’s all to fight for in that regard”.

Lose influence with the EU

Of course, the UK will lose most of its influence over the operation of EU institutions, including the European Investment Bank and the European Commission, which delivers a large chunk of the DfID aid budget will probably continue to do so, for practical reasons at least.

“We will continue to contribute to the EC’s aid budget in the years to come and although the UK is desperately trying to get some kind of seat at that table, it is not very likely to happen. In most cases the UK will have to accept decisions of the EU with very little influence over them. We knew that, though, didn’t we – that was kind of the point of Brexit.”

Financial sector regulation

But the biggest change, he predicted, would be in the political dynamic between the EU and the City of London, and whether the EU will try to limit London’s power to “water down” financial sector regulation.

“The City of London is the largest financial centre in the EU and one of the biggest facilitators of tax havens, tax avoidance and so on. What will Brexit mean for financial sector regulation, for our efforts to, for example, close down tax havens or stop tax-dodging by multinational corporations? How much will the EU take aim at the City of London after Brexit, and what does that mean for UK actors trying to influence those discussions?

“I think the EU may try to minimise the role of the City of London and all the problems it causes in the global economy. If the EU uses its power to cut off access to the EU financial sector from the UK, it could have a major impact on the UK’s ability to continue to be one of the leading global financial sector players. Is there a financial sector regulation fight coming?”

‘No guarantees’

He added the caveat that there is no guarantee the EU will pursue a better policy after Brexit, as that relies on EU organisations to stand up to financial sector lobbyists from other member states. “The UK isn’t the only tax haven sponsor in the EU – there’s also Ireland, the Netherlands, Luxembourg; these are all big problems for the global financial system and we’ve also got to tackle those. But it becomes easier without the biggest sponsor in the club any more.”

Griffiths also warned there is a possibility that this shift could go the other way if, as some pro-Brexiteers in the current government have mooted, the City of London becomes “Singapore on Thames”, an even more highly deregulated offshore entity next to the EU.

“But, on the balance of probabilities,” Griffiths concluded, “I predict the EU will take aim at the UK and make problems for that role.”

A no-deal Brexit

Griffiths also said that if there is a no-deal Brexit the cost to developing countries could be £60bn in lost revenue from a big devaluation of the pound and a recession in the UK that affects the UK aid budget.

|

Related articles