Dover Corporation: King of Dividend Kings Boosts Annual Dividend 64th Consecutive Time (NYSE:DOV)

By: Ned Piplovic,

When the Dover Corporation (NYSE:DOV) began its current streak of consecutive annual dividend hikes in August 1956, Dwight Eisenhower was the President of the United States running for his second term, Bob Barker had not made his television debut and Elvis Presley had not appeared on the Ed Sullivan Show yet.

However, the Dover Corporation managed to maintain its streak of annual dividend hikes for more than six decades. With its current dividend boost, Dover extended this streak to 64 consecutive years and broke the tie with the Procter & Gamble Company (NYSE:PG) for the longest steak of dividend hikes among Dividend Kings, as well as all S&P 500 companies.

Currently, there are only 13 S&P 500 companies that have raised their annual dividends at least 50 consecutive years. Among these dividend kings, the Dover Corporation is truly the king. A slightly less exclusive group of S&P companies with at least 25 consecutive annual dividend hikes, still contains just 57 companies.

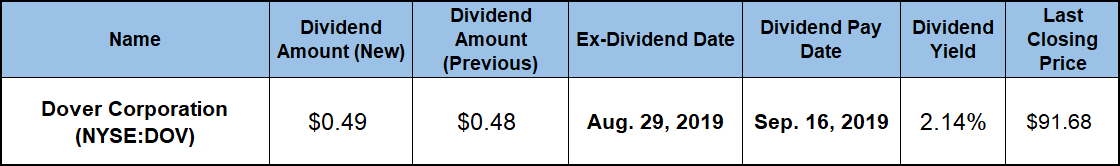

Income investors interested in getting on board the longest train of consecutive annual dividend hikes should consider acting before the upcoming ex-dividend date on August 28, 2019. All investors that can Dover Corporation stock ownership before that ex-dividend date will be eligible to receive the next round of dividend distributions on the upcoming September 16, 2019, pay date.

Dover Corporation (NYSE:DOV)

Headquartered in Downers Grove, Illinois, and founded in 1947, the Dover Corporation provides equipment and components, software and digital solutions, specialty systems, consumable supplies and support services worldwide. The company operates through three business segments — Refrigeration & Food Equipment, Engineered Systems and Fluids. The Refrigeration & Food Equipment segment manufactures refrigeration systems, refrigeration display cases, specialty glass, commercial glass refrigerator and freezer doors.

The Engineered Systems segment offers precision marking and coding, digital textile printing, soldering and dispensing equipment, and related consumables and services. Additionally, this segment also offers automation components, including manual and power clamps, rotary and linear mechanical indexers, conveyors, pick and place units, glove ports and manipulators. Furthermore, the Engineered Systems segment also offers end-of-arm robotic grippers, slides, end effectors for fast-moving consumer goods, vehicle service and environmental solutions.

Lastly, the Fluids segment handles fluids across the retail fueling, chemical, hygienic, oil, gas and industrial markets. This segment also manufactures pumps for transfer of liquid and bulk products in various markets, including refined fuels, liquefied petroleum gas and food transportation. Additionally, the Fluids segment offers pumps and connectors for use in various bio-processing, medical and specialty applications, as well as pumps, filtration systems, pelletizing equipment, compressors and bearings for use in the chemical, polymer, power generation, oil, gas and marine industries.

Dividends

The company boosted is total annual dividend for 2019 by increasing its third-quarter dividend payout amount 2.1% from $0.48 in the previous period to $0.49 for the next round of dividend payouts. This new quarterly payout corresponds to a $1.96 annual dividend, which currently yields 2.14%.

While 17% lower than the Dover Corporation’s own 2.59% five-year average, the current yield fares much better when compared to average yields of Dover’s industry peers. The 2.14% yield is 71% higher than the 1.25% simple average yield of the overall Industrial Goods sector, as well as nearly 80% higher than the 1.19% yield average of Dover’s peers in the Diversified Machinery industrial segment. Furthermore, Dover’s current yield also outperformed by 16% the 1.84% average yield of only dividend-paying companies in the Diversified Machinery industrial segment.

With the longest record of annual dividend hikes among all S&P 500 companies, Dover has been increasing its annual dividend amount for many decades. Just over the past two decades, the company enhanced its total annual dividend payout 325%. This advancement corresponds to a 7.5% average annual growth rate over the last 20 years. Additionally, Dover also managed to deliver a growth rate of more than 5% over the last five years.

Share Price

Riding a small pullback that began in January 2018, the share price entered the current 12-month period trading mostly sideways for several months in the second half of 2018. Ultimately, the share price succumbed to the downward pressure of the overall market correction at the end of the year. During three weeks in December, the share price lost nearly one quarter of its value before hitting its 52-week low of $66.53 on December 24, 2018.

However, the share price reversed its downtrend at the turn of the year and recovered almost as quickly as it suffered the losses in December. Before the end of January 2019, the share price had gained nearly 30% and recovered fully from its pullback in December 2018.

After another two weeks, the share price regained some additional losses and exceeded it previous peak to set a series of new all-time highs between mid-February and early-July 2019. The share price reached its most recent all-time high of $103.39 on July 3, 2019.

After peaking at the beginning of July, the share price pulled back 11% and closed at the end of trading on August 21, 2019, at $91.68. While more than 10% below its recent peak, the Aug. 21 closing price was still 8.3% higher than it was one year earlier and nearly 39% above the 52-week low from Christmas Eve 2018. However, because of a 40% decline between August 2014 and the end of 2015, the share price gain over the last five years was limited to less than 30%.

However, the share price received some minor assistance from the company’s dividend income distributions toward substantial total returns. The dividend income provided nearly one fifth of the 11% total return over the trailing 12-month period. As already indicated, a significant pullback kept capital gains below 30% for the five-year period, which also limited the total returns to 36% for the same time frame. However, the total return over the last three years was more than 61%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic