WITH ITS SANDY BEACHES stretching alongside the Arabian Sea, chill vibes, and great food, Goa is a global holiday destination that attracts millions of visitors from around the world. But while the former Portuguese colony is best known for its beaches, its rivers are fun, too. Take the Mandovi, for instance. The river, which cuts across Goa’s capital city of Panaji, shimmers in the evenings with a kaleidoscopic reflection of the city lights and six beautifully lit ships.

The presence of these floating vessels isn’t merely ornamental. They are the casinos that make Goa the gaming capital of the country. These casinos aren’t exactly the gambling grandeur that you’d expect in the desert strip of Las Vegas in the U.S., or the uber luxury experience in Monaco in the French Riviera. But for many leisure travellers who come to Goa to spend quality time on the beaches during the day, these casinos are the go-to place in the evening. Besides staying open and serving liquor all night long, they offer an adrenaline rush, the way only gambling can: You take on the house by placing a bet and always hope to recover a portion of what the holiday cost you.

Three of these six gaming ships on the Mandovi are owned by one company: Mumbai-based Delta Corp. Its flagship in Goa, the Deltin Royale, is also the largest gaming vessel on the Mandovi and one of the largest casinos in India.

Spread across four levels, the Royale resembles a giant, vintage ballroom—with carpeted flooring and chandeliers hanging from the ceiling—with gaming stations offering everything from Texas Hold’em Poker, American Roulette, and Blackjack to Indian variations such as Teen Patti.

Patrons range from newly-wed couples and college friends to individual business - men and professionals who are regulars. There are dedicated rooms for regular high-rollers and poker players; and for those not interested in the gambling, the top deck of the ship offers food and live entertainment and a great view of the city.

A Delhi-based tax lawyer, who didn’t want to be identified, says that the Royale is the best casino in Goa. “I go there five to six times in a year on an average and its size, décor, variety of games, and professionalism of pit bosses make for a good gaming experience,” he says. “Though beverage service can be slow, and the place tends to get overcrowded at times, it is the best option for those who want to gamble and cannot always travel to places like Macau.”

OVER A SPAN OF 15 YEARS, Delta’s founder and chairman Jaydev Mody, 64, has assiduously built a ₹800-crore gaming empire— under the ‘Deltin’ brand—in a country where gambling is often looked at as a social taboo. Being a political hot potato, especially during elections, strict regulations make it difficult to grow the gaming business in India. Despite that, Delta Corp. is No. 374 on this year’s Fortune India Next 500 list, rising sharply from No. 447 last year.

According to Delta’s latest investor presentation, the gaming market in India is estimated to be worth $60 billion per year, with casinos having an estimated annual turnover of $200 million. The organised market is barely 0.5% of the total market, Mody says. Most punters in India bet on sports—ranging from legal horse racing to illegal betting on cricket. While 12 states allow lottery in India and six allow horse racing, only two states—Goa and Sikkim—and one Union Territory—Daman—allow casino gaming.

SOURCE: DELTA’S INVESTOR PRESENTATION

Mody contends that responsible adults know what is good and bad for them, and those who are addicted to gambling will do so anyhow. “Smoking and drinking are more damaging than spending a fun night of gaming. But cigarettes and alcohol aren’t banned. And if people don’t gamble in a casino, they will go and play matka [an illegal form of lottery] and other forms of totally unregulated games, which can have more serious repercussions,” he says. Moreover, Deltin’s casinos have monitoring systems which can track if someone has a habit of coming in month after month and losing sizeable sums. Such a person is eventually barred from entry, Mody says.

When the late Manohar Parrikar of the Bharatiya Janata Party was the chief minister of the state, the Goa government had mooted a proposal of moving the casinos out of Panaji and on to non-agricultural land near a proposed new airport. For this, Delta acquired land worth ₹140 crore near the upcoming airport, but there is a lack of “political will” to see the project through, says Mody. “We are now thinking of building an electronic casino (which is allowed under the current policy), a water park, banquets, and retail on this land,” he adds. An electronic casino is much like a traditional one with the addition of a few screens where games like Blackjack can be played digitally.

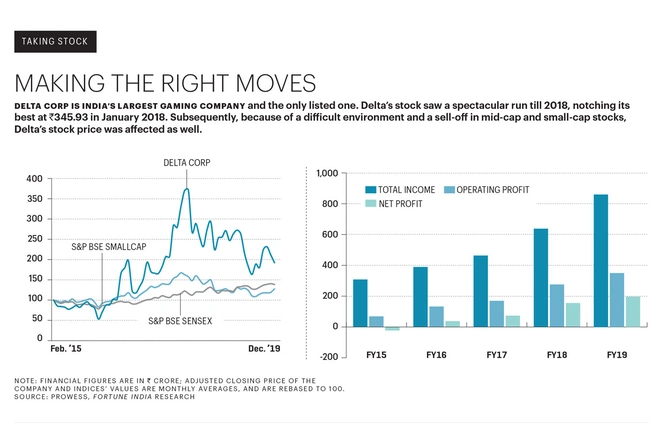

Despite such constraints and local competition (its nearest competitor, the Pride Group, has two offshore and two land casinos in Goa), Delta is the only large, listed player in this space and it is growing each year. Between FY16 and FY19, Delta’s revenue has doubled, and net profit has quintupled. The company’s Ebitda margin has steadily improved from 33.55% in FY16 to an impressive 42.21% in FY19.

In India, Delta runs four casinos in Goa, one in Sikkim, and a hotel each in Goa and Daman. The Deltin Daman was built after the government agreed to issue a gaming licence if someone built a five-star hotel in the Union Territory. But when Delta did that and went to the government for the gaming licence, the government dragged its feet without offering any explanation, Mody says. The matter is currently in court.

To work around the challenge of setting up new casinos in India, Delta picked up a 30% stake for $10 million in Essel Groupbacked Jalesh Cruises in 2019. The deal gives Delta exclusive access to run casinos in all cruise ships operated by Jalesh (the casinos are thrown open to customers once the ship sails out into international waters).

Also, with online gaming—including skill-based games such as poker, rummy, and fantasy sports that can be played for real money—catching on fast in India, Delta has branched into this space too. In 2017, Delta acquired Adda52.com, India’s largest online poker destination, and in 2019 it picked up a 19.5% stake in fantasy sports site HalaPlay, in which it co-invested along with gaming company Nazara Technologies. “These are all connected businesses and have synergies with our existing operations,” Mody says. Adda52, for instance, had a top line of around ₹170 crore in FY19 as compared to ₹54 crore in FY16. The online gaming market is estimated to be worth $1.1 billion by the end of 2020.

“Delta has built a great consumer business at a time when gaming—physical and online—has become a real thing,” says Rakesh Jhunjhunwala, who owns a 7.5% stake in the company and sits on its board of directors. Responding to the criticisms levelled against the gaming business in India, Jhunjhunwala says that any change brings about contempt and opposition, but at the end of the day Indians will gamble. “It [gambling] is a part of our culture dating back to the Mahabharata,” says Jhunjhunwala, often referred to as India’s Warren Buffett. “The key to being successful is to run the business in a responsible manner and be conscientious.”

“We are very strong on compliance and professionally run,” Mody says. “We aren’t a one-man operation like some of our competitors. We have a plan in place, cash on our books, and no debt.”

CASH-RICH AND DEBT-FREE is an enviable position to be in, especially given the current business environment. There is ₹500 crore of cash sitting on Delta’s books and the business throws out around ₹225 crore of cash each year. In addition to this, Delta has assets worth around ₹400 crore, including land banks, which it can monetise. That’s perhaps why, despite the slowdown, Mody is unruffled when he meets Fortune India at Delta’s headquarters in Mumbai’s Tardeo area. Business hasn’t grown much in the current financial year, which Mody expects will see Delta report a top line similar to what it did last fiscal. This also reflects in the market capitalisation of the company, which has fallen around 48% between February 2018 and January 2020. The company’s current market cap stands at ₹4,129 crore, as of February 26, 2020.

But Mody, who also holds a majority stake in the FC Goa football team that plays in the Indian Super League, is confident that the market will eventually reward Delta for its business vision and execution skills. A key future strategy for the company, towards this end, is to expand internationally. In February, Delta opened its first casino outside India in Kathmandu—its first step towards going international. The casino is part of a new hotel that Marriott recently opened in Nepal’s capital city. Mody says that he wants to control the gaming market in Nepal, much like he controls it in Goa. “The plan is to grow there and attain market leadership in three years. We want to have four to six casinos and be the largest brand there,” he says. If needed, Delta is also willing to build a hotel in Nepal to control the market and clientele there.

Though Deltin has two hotels in India—Goa and Daman—Mody doesn’t fancy himself as a hotelier and says that he, in fact, doesn’t like the hotels business. For him, hotels are just a necessity to control and retain his clientele. Delta also wanted to expand in Sri Lanka and had acquired land near the Colombo airport, but the previous government had restricted gaming licences to the two operators who currently run casinos there.

HOW DELTA UPPED THE ANTE

Delta Corp, which began operations in 2006-2007, opened its first casino outside India this year in Kathmandu, Nepal.Between FY16 and FY19, Delta’s revenue doubled, and net profit quintupled. These are the milestone moves it made to get to its current position:

TIME FRAME: 2010-2013. KEY EVENT: FIRST MAJOR FUNDING

DETAILS: Acquires Casino Caravela, its third offshore casino;raises $43 million from ace investor Rakesh Jhunjhunwala and group. Jhunjhunwala owns a 7.5% stake in the companyand sits on its board of directors.

TIME FRAME: 2013-2014. KEY EVENT: GETS INTO HOSPITALITY BUSINESS

DETAILS: Commences hospitality operations at Deltin Daman; launches land-based casino at Deltin Suites in Goa, and Deltin Royale—which it claims is Asia’s largest offshore casino.

TIME FRAME: 2015-2017. KEY EVENT: BUYS ADDA52.COM

DETAILS: Acquires Adda52.com, India’s leading online poker site (Adda52 had a top line of around ₹170 crore in FY19 as compared to ₹54 crore in FY16); completes a qualified institutional placement of $84 million; and launches land-based casino in Sikkim.

TIME FRAME: 2018-2019. KEY EVENT: BUYS STAKE IN JALESH CRUISES

DETAILS: Acquires a 30% stake in Jalesh Cruises for $10 million—the deal gives Delta the exclusive access to run casinos in all cruise ships operated by Jalesh; acquires 19.55% stake in HalaPlay, a fantasy sports site for $3 million, co-investing with gaming company Nazara Technologies.

With a new government in Sri Lanka, Delta wants to try its luck again since a presence there would help it cater to clients from India’s southern states such as Karnataka, Kerala, and Tamil Nadu. Does the international push mean it plans to enter traditional casino markets like Las Vegas, Atlanta, or Singapore? Unlikely, Mody says. “We can acquire a hotel and casino in Vegas for a couple of hundred million dollars if we want to. But we best understand the Indian players and devise games around them. And if there is no India element, we won’t enter a market just for the sake of it,” he says.

Mody, who is passionate about horses (he owns over 50) and wagers more on the racecourse than in casinos these days, says he is a “controlled gambler” and hates losing money like all good Gujaratis. Good thing he in the casino business then because here the house always wins.

This story was published in the March 15-June 14 special edition of the magazine.

Leave a Comment

Your email address will not be published. Required field are marked*