New taxes and fees on Illinois driving, vehicles total $1.9B

Jan. 1 marks a second wave of taxes aimed at drivers to support an infrastructure package championed by Gov. J.B. Pritzker and shrouded in corruption allegations.

As the calendar flips to 2020, Illinois drivers will be hit particularly hard by the second phase of 20 new taxes and fees passed by Illinois leaders this year that total $4.6 billion.

Among the 20 taxes and fees were six new ways to take money from the state’s drivers. In total, Illinois drivers will pay an additional $1.92 billion in various taxes for driving, parking, selling or simply owning a vehicle.

Those new taxes will go to fund Gov. J.B. Pritzker’s record $40 billion state budget and $45 billion “Rebuild Illinois” plan. Despite the tax hikes, the budget remains as much as $1.3 billion out of balance. The infrastructure plan has been criticized for a lack of independent project scoring and planning. It contains at least $1.4 billion worth of waste such as pickleball courts, dog parks and renovations to a shuttered theater to fulfill lawmakers’ wish lists rather than public improvement needs.

Two of the plan’s key proponents in the General Assembly have since announced their resignations in the wake of corruption scandals.

State Sen. Martin Sandoval, D-Chicago, saw his home and office raided by the FBI in September. He bragged about being the architect of the state’s doubled gasoline tax and shepherded Pritzker’s infrastructure plan as chairman of the Senate Transportation Committee. He resigned as chair and announced he is resigning from the Senate on Jan. 1 after allegations that he used his position to get his daughter and daughter-in-law jobs with the Chicago Transit Authority.

State Rep. Luis Arroyo, D-Chicago, was indicted by federal prosecutors on allegations he tried to bribe a senator in exchange for voting on legislation that benefitted a company for which Arroyo did lobbying work. As a House appropriations committee chair, he was a key supporter of the infrastructure plan. He has since resigned his House seat.

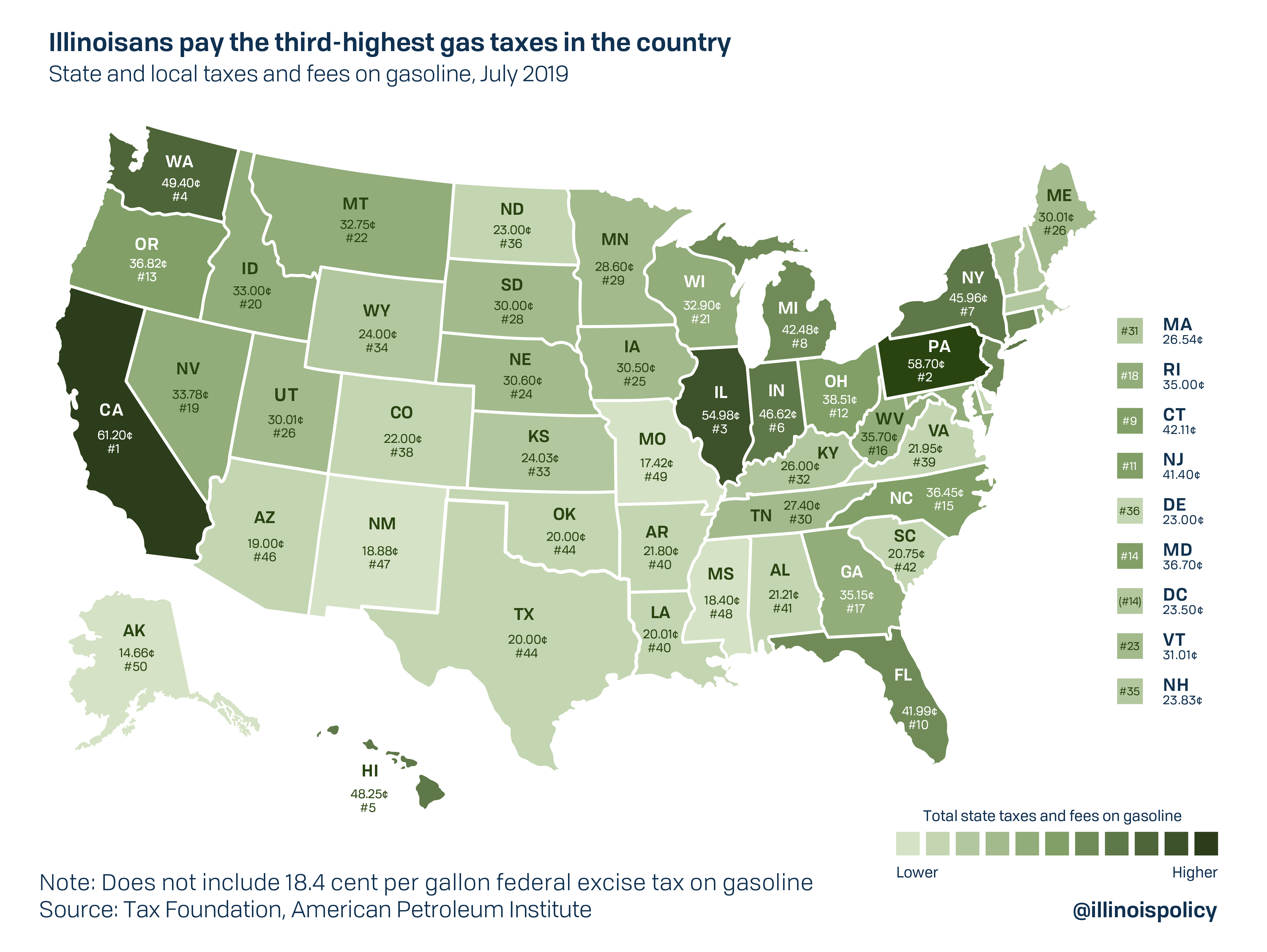

Illinois taxed drivers significantly more to fill their vehicles. A doubled motor fuel tax is projected to bring in $1.3 billion. The hike to 38 cents per gallon from 19 cents per gallon is costing drivers an extra $100 each year. Illinois now boasts the third-highest gas tax in the nation. But the tax will go higher: Lawmakers ensured the tax will increase annually based on inflation, meaning the hike could end up at 43.5 cents by 2025.

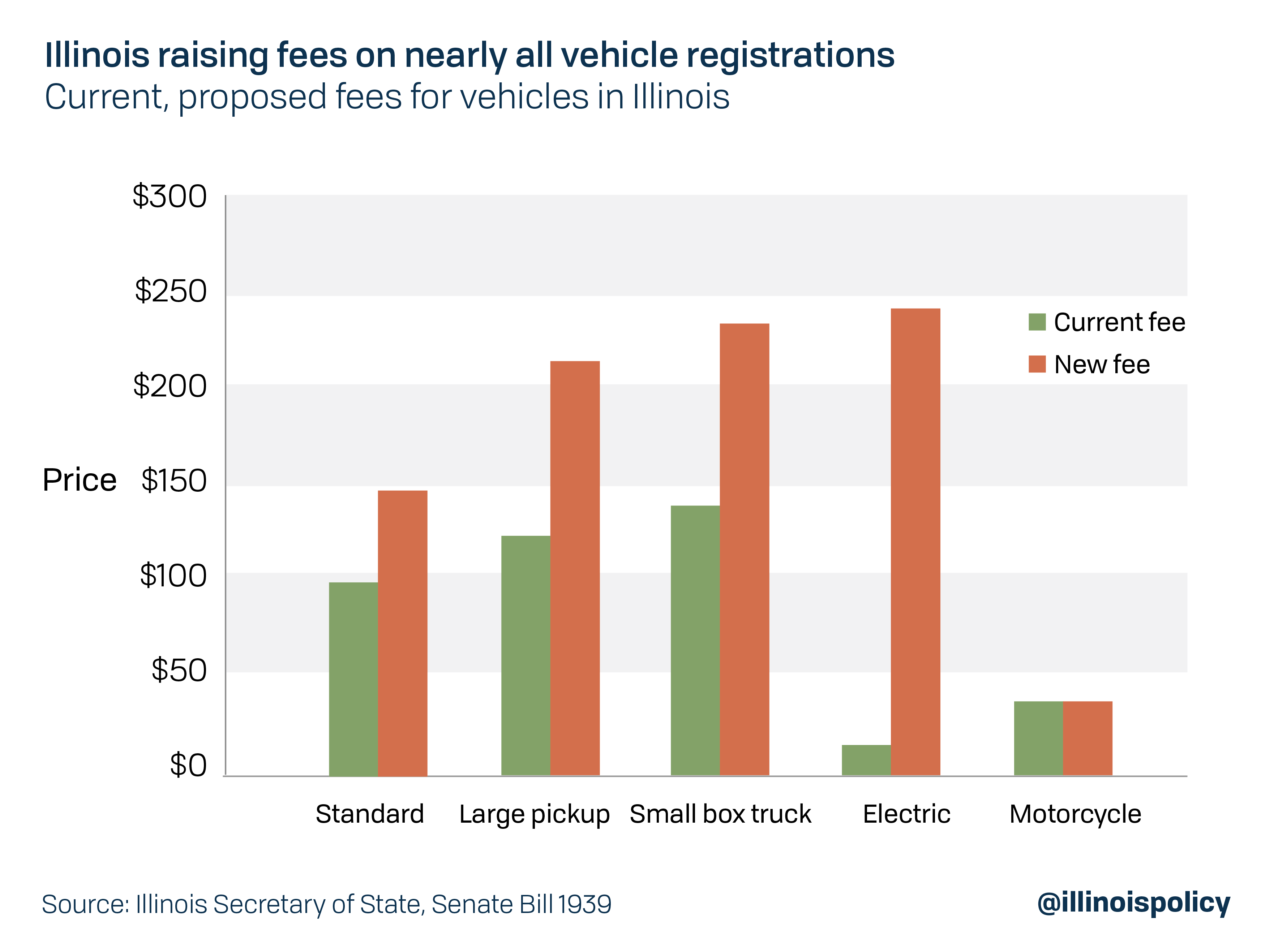

Illinois is taxing drivers significantly more to own their vehicles. The registration fee for regular passenger vehicles will jump to $151 from $101 on Jan. 1. The higher registration fee is supposed to collect an additional $441 million. When combining the $50 hike with the gas tax, a typical family with two cars will pay $300 more each year just on their vehicles.

The annual fee for other types of vehicle registrations also increased. Larger trucks will cost $100 more to renew each year, while registration for electronic vehicles will be $250 per year, up from just $35 every other year. The increase on trucks and other large vehicles will generate $49 million, while the electronic vehicle hike will bring in an additional $4 million.

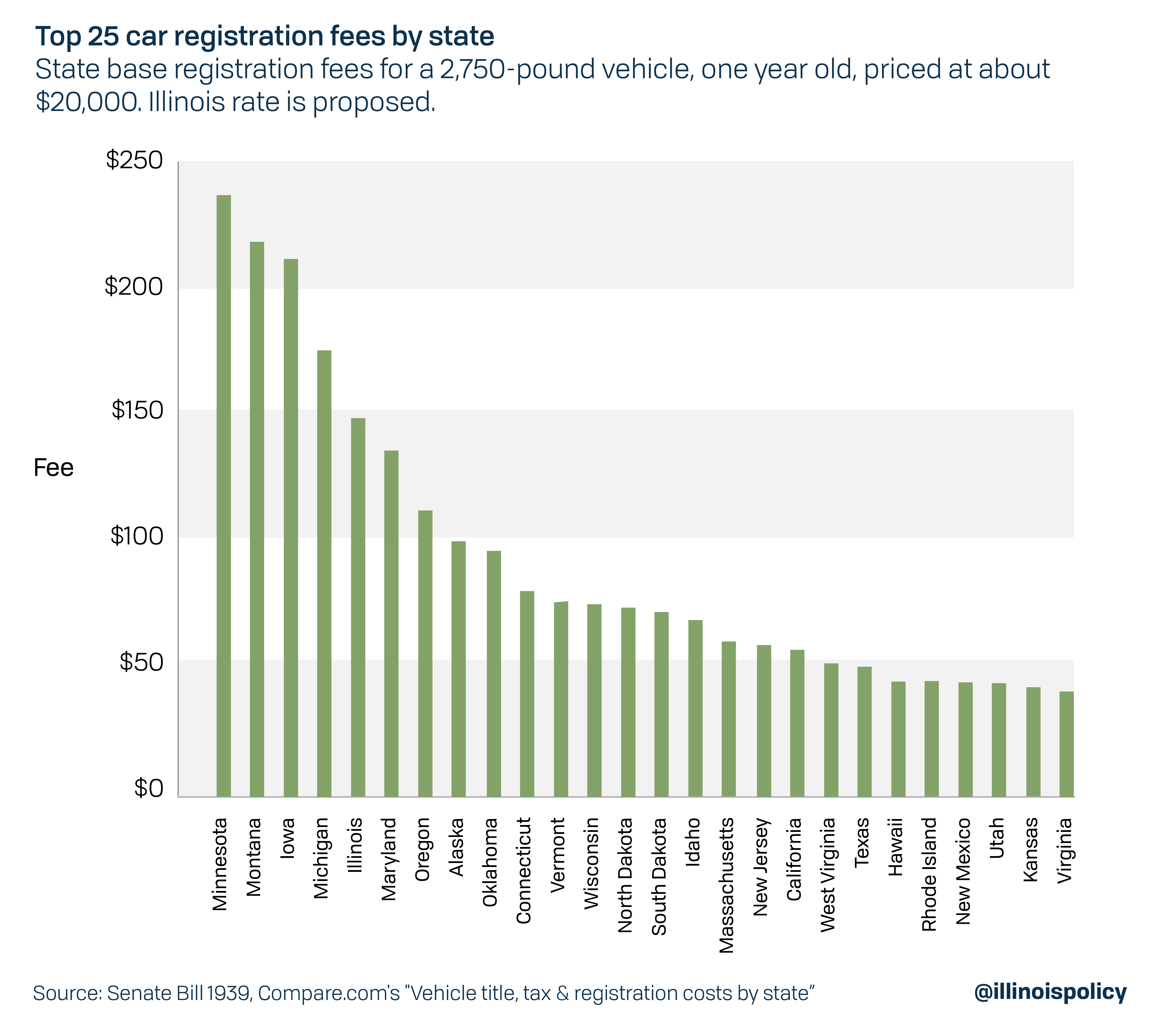

Illinois already had the highest vehicle registration fee of any neighboring state at $101. Now the state will be far ahead of the rest of the nation, with the fifth-highest overall fee in the country.

Illinois is taxing drivers significantly more to park their cars. A new tax on parking garages will take effect Jan. 1. Hourly and daily garages will be taxed at 6%, while monthly or annual parking will be taxed at 9%. This tax is supposed to bring in $60 million. These funds will not go to roads and transportation, but rather to vertical infrastructure such as state building renovations.

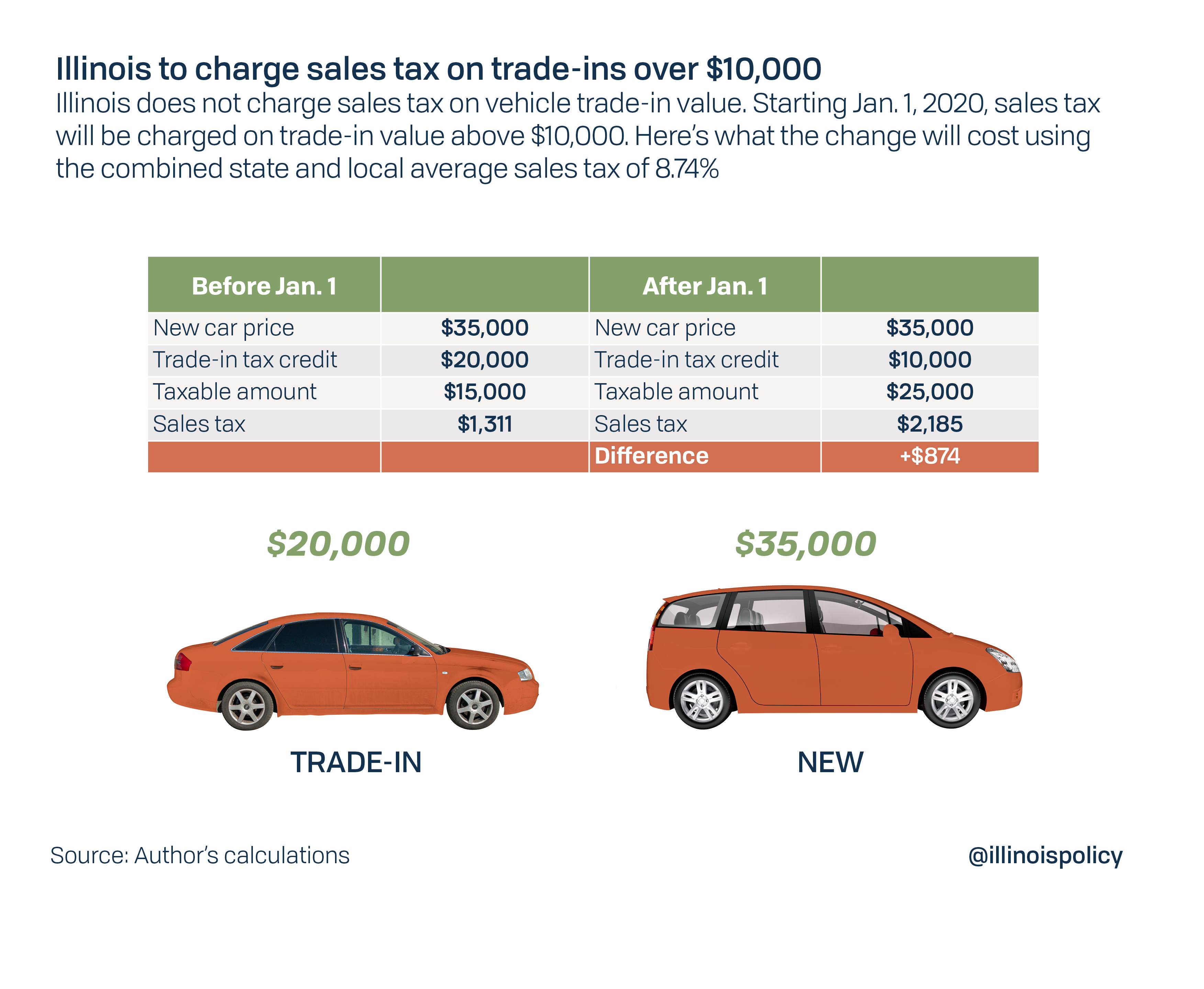

Finally, Illinois is taxing drivers significantly more to get rid of their cars. Illinoisans will be charged both state and local sales taxes when they trade in a vehicle over $10,000. This will generate another $60 million, which, again, is not helping improve roads but rather going to those pickleball courts, dog parks and other vertical infrastructure. The trade-in tax will average nearly $1,000 more and is a form of double taxation. Owners were charged sales taxes once when they bought the cars new and are being taxed a second time for those cars when they are traded for another new car.

Illinois drivers didn’t get to vote on any of these tax hikes or on the corrupted deals that their money will finance, but they will have a chance Nov. 3, 2020, to decide whether they trust lawmakers with greater power to raise their state income taxes.

Gov. J.B. Pritzker’s progressive income tax hike will be on the ballot. Pritzker has branded his $3.4 billion tax hike proposal as the “fair tax,” although nearly half of Illinoisans see it as a “blank check” for Illinois lawmakers to continue spending more.

Taking more tax dollars from Illinoisans has not fixed state finances. But Illinoisans have been clear that adding more taxes will drive more of them out of the state.