Sitka’s village Native corporation, Shee Atiká, held board elections in May. An independent candidate won a seat at the table, after working around obstacles and navigating complicated corporate law — a process that some shareholders believe is unfair and should be reformed.

There are 9 people on the Shee Atiká Board of Directors. Each year three are up for election. More often than not, incumbents or those selected by the board as the “board slate candidates” take seats.

But for the last few election cycles, a grassroots movement of Shee Atiká shareholders, unhappy with the direction of the corporation, have rallied support for independent candidates. Board member Larry Garrity was elected in 2017, and at this year’s annual meeting in Anchorage, another independent candidate, Norma Perkins of Sitka, received over one-third of the votes cast, and is now the Shee Atiká board secretary.

Sitka shareholder Clarice Johnson says there’s a reason that independents have had recent success. Shareholders are dissatisfied with the status quo and are pooling their votes to gain momentum.

“We have the option to create our own slate which is three or more board candidates running together. This gives people an advantage because they can combine their votes,” Johnson says. “And if they don’t have enough votes to put everyone on individually, a person can drop out and give their votes to another candidate. It’s one of the few ways we can overcome obstacles that board puts in the path of people who want to be elected.”

Among those obstacles is running afoul of the regulations governing elections for Native corporations.

In April, Johnson wrote a social media post that encouraged shareholders to vote for the three candidates listed on the independent “owner” slate: Perkins, fellow Sitkan Dionne Brady-Howard, and Jim Wilkins of Anchorage. She posted to the public Facebook group, Sitka Chatters. But she didn’t think her post was going to cost her $1,500.

“As someone who had worked on previous campaigns,” she says, “I was aware that all candidates and proxy holders needed to file any public posts with Banking and Securities in a timely manner.”

Johnson wasn’t running for a seat on the board, and she wasn’t a proxy holder. Nevertheless, someone filed a complaint about her post with the state Division of Banking and Securities. That’s the agency that enforces election proceedings for Alaska Native corporations under the Alaska Native Claims Settlement Act. These rules have been in place for decades, but Johnson says she was surprised that all shareholders were being held to the same level of scrutiny.

“I was not aware that any shareholder who had an opinion and expressed it in a public way, theoretically could have a complaint filed against them,” she says.

The division ruled that Johnson’s post was soliciting proxy votes, which obligated her to file a report with the division. The oversight cost her $1,500.

“If you’re found guilty, you’re essentially put on probation for five years. You have the $1,500 fine over your head,” she says. “I can’t believe that many shareholders realize simply using free speech to express their opinions about their corporation could land them in legal trouble.”

Lloyd Miller is a Native rights attorney in Anchorage. He says that while corporate law can land shareholders like Johnson in hot water, the rules can be especially tricky for candidates to navigate.

“If it minds its p’s and q’s and pays enough money for hourly services from a good law firm, management generally will avoid violating state and corporate law,” says Miller. “It’s very hard for a candidate who’s not supported by management to get access to the legal resources that candidate needs to make sure that she or he doesn’t violate those same laws.”

Miller says Banking and Securities is generally pretty good about helping people so they don’t make mistakes and get fined, but the lack of professional legal guidance makes it difficult. And the expense is another hurdle.

“The candidate may have to incur considerable expense doing outreach to the shareholders to convince the shareholders to vote for him or her instead of the three candidates on the management slate,” says Miller.

One of those expenses for the independent candidates Johnson was supporting? Electronic voting. Miller is not exaggerating by describing the expense as “considerable.” Johnson considers it yet another obstacle for independent candidates.

“People do prefer to vote electronically if possible and Shee Atiká offered additional prizes for people who would vote electronically. The Independent slate had the option of having their own electronic voting site,” but Johnson says the cost was high. “It would have been, estimated, I think I heard $30,000 to $40,000 dollars to have a secure portal.”

The incentives that Shee Atiká and other corporations provide for voters aren’t illegal, as they’re applied equally to all candidates. But the practice of proxy voting can appear to turn a voting incentive into an advantage for the management slate.

Shee Atiká’s management says its election practices are regulated by state law, and are required to be fair. CEO Ken Cameron agreed to be interviewed for this story, but declined to be recorded.

Independent candidates are just that, Cameron told KCAW. They’re independent. And as for why the corporation even provides incentives to begin with, Cameron says they’ve had trouble reaching quorum in the past.

Cameron says if candidates go through the proper channels but aren’t selected as board candidates, they can still be on the electronic, board proxy running as independent candidates “below the line,” and voting for them still puts shareholders in the pools for the electronic incentives and the $25 board proxy reward.

To make things even more complicated, there’s a write-in option on the corporate proxy, where a shareholder could write in an independent “owner” candidate’s name and still be eligible for all of the prizes- both the electronic voting prizes and the $25 dollars for submitting the corporate proxy.

But, only the votes for the first write-in candidate will be counted- votes for any other candidates become “discretionary to the board’s proxy holders” according to Shee Atika’s policies.

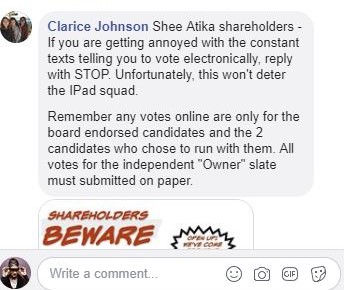

Clarice Johnson says this limits some of the power shareholders have in the vote pooling process, which is why she pushed for people to vote using a paper proxy in the Facebook post that earned her a fine.

Compared to how most Americans vote, none of this is especially straightforward. Johnson feels that Shee Atiká’s election practices are designed keep corporate-sponsored candidates in power, particularly the $25 dollar prize Shee Atiká offers if a shareholder votes with a corporate proxy.

“Although it may be legal to do it this way it seems highly unethical and unfair.”

But with momentum building around independent candidates — and some costly lessons from regulators — , perhaps achieving quorum in the future won’t require any other incentive other than the desire for change.