California’s economy will grow faster than the nation’s, UCLA forecast predicts

California’s economic growth will slow next year, but it is likely to outshine that of the nation overall, as Golden State employers boost payrolls, according to a new UCLA Anderson School forecast.

Even as recession fears haunt the ongoing expansion, California’s economic output expanded by 2.6% this year, albeit down from 3.5% in the last quarter of 2018.

“This is still above the U.S. rate,” wrote forecast director Jerry Nickelsburg, noting that U.S. GDP grew by 2.1% in the last quarter. “While we expect further slowing of the California economy as part of the U.S. economic growth slowdown in 2020, this differential is expected to persist.”

The 134-page UCLA forecast, a widely watched and often-cited quarterly outlook for California and the nation, offered analyses on the likelihood of recession, the health of the housing market, the impact of the trade war and the geographic distribution of educated workers.

“The forecast is now somewhat more optimistic than it was just three months ago, as a number of fears have been eased,” the authors concluded.

California

California’s major population regions experienced job growth above 2% this year, except for Sacramento and Los Angeles. The U.S. outside of California experienced just 1.35% growth, the same as Los Angeles.

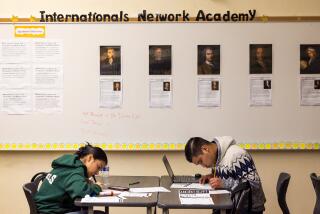

Nonetheless, the forecast noted, the high cost of housing and the Trump administration’s immigration restrictions threaten to hamper growth in the Golden State. Many California businesses ranging from Silicon Valley tech firms to the Central Valley farms to Los Angeles’ restaurants and hotels rely heavily on immigrant labor.

Growth rates vary in different parts of the job market, the forecast notes. High-value-added sectors, such as information, professional and business services, and construction, grew more slowly in recent months. Hiring in government, temporary and administrative services, private education and durable goods manufacturing grew more quickly.

Two bright spots: California’s logistics industry, propelled by its giant Southern California ports, and its booming tech sector are likely to continue to grow faster than those industries in the rest of the nation.

In 2020 and 2021, the forecast predicts average unemployment rates of 4.3% and 4.6% respectively. In October, California joblessness stood at 3.9%, the lowest rate since 1976, when the state changed its statistical methodology, adding new data to its calculations.

The UCLA economists expect state payrolls to grow in 2020 and 2021 by 1.9% and 0.9% respectively.

Wage inequality has risen more in California cities than in the metropolitan areas of any other state, with seven of the nation’s 15 most unequal cities located in the Golden State.

At the same time, real personal income is forecast to grow by 2.1% and 1.9% in 2020 and 2021, reflecting a changing mix of employment in California and a tight labor market in high-wage occupations.

Housing

Falling mortgage interest rates early this year pushed up California home prices “but did little to revitalize the real estate market,” Nickelsburg wrote, noting that the annual home-building rate has remained in the range of 100,000 to 115,000 since the summer.

Some of that construction was for rebuilding homes lost in natural disasters, he added, so “the state has clearly fallen behind in home production relative to population growth and future needs, and this is not expected to change any time soon.”

He expects a modest increase in building followed by increased slack as the nation’s economy softens in late 2020. That could be followed by a slow recovery of home building through 2021.

Even with state and local moves to ease regulations and zoning, Nickelsburg wrote, “the prospect for the private sector building out of the housing affordability problem over the next three years is nil.”

Logistics and tech

President Trump’s trade war with China poses an outsize threat to California, given that some 200,000 businesses import goods through the San Pedro Bay ports, accounting for about 40% of the nation’s imports.

Total goods movement through the ports of Long Beach, Los Angeles and Oakland for the quarter ending in October are down by 4.5% from the previous year. International air cargo at Los Angeles and San Francisco airports has dropped by nearly 10% over the same period.

Robots are coming to the massive ports of Los Angeles and Long Beach, replacing dockworker jobs. But truckers are delighted, since they’ll be able to move cargo faster, earning more money.

Nonetheless, overall jobs have not dropped in transportation, warehousing and utilities since the summer. While traditional retailers are threatened by the growth of Amazon, the online delivery business has a bright side, according to the forecast.

“The shift from brick-and-mortar to online retail has kept the trade war disruption from having a major impact on employment in the logistics industry. In addition, the backlog of demand for warehouse space has kept absorption of new industrial buildings at high levels.”

In an essay accompanying the forecast, economist William Yu noted that education levels — or what he calls “human capital” — are far from equal across the country, but tend to be higher in larger cities than in small towns.

For adults 25 to 34 years old, he wrote, “California had the highest human capital gain from 2011 to 2017 among 50 states, possibly because of the tech boom that attracted a highly educated workforce during the same period.”

Recession?

UCLA economist Edward E. Leamer delved into several economic models to look at the likelihood of a national recession. His best guess? A 17% chance that a recession will begin sometime between the fourth quarter of 2019 and the third quarter of 2020.

“Who should worry about a recession?” he asks. “Everyone should.”

As for which occupations might prosper more in a downturn: “Education and health services is the clear winner. Government is good, too, with jobs that grow even in recessions.” He suggests being “wary of manufacturing, mining and information … the movie business as well as software.”

Leamer’s advice: “Now is the time for a personal stress test: Is your family/business relying on income from jobs or sales that are threatened? Do you have debt service obligations that depend on those earnings or do you have other threatened earnings? If yes, sell off some assets to retire some of that debt.… Cash is what you want in a recession when asset prices are plummeting.”