China’s rare earth stocks are investors’ new hedge against trade war as Beijing rolls out countermeasures against Trump

- Expectations that China will cut overseas supply of rare earth have spurred at least 34 per cent gains in linked shares

- But watch out – share prices could plunge if trade war is settled, analysts say

In a twist, traders have found a hot new bet in China’s stock market that has churned out jaw-dropping gains specifically because of deteriorating US-China relations: rare earths.

While the benchmark gauge Shanghai Composite Index has remained in the doldrums over the past month amid the trade stand-off between Beijing and Washington, China Minmetals Rare Earth, China Northern Rare Earth (Group) High-Tech and other major producers of the elements have shot up at least 34 per cent, making them the hottest trade on the mainland’s exchanges.

“If there is a disruption of supply, the hi-tech industries in the US will be affected and that’ll lead to an increase in rare earth prices,” said Ken Chen Hao, a Shanghai-based strategist at KGI Securities. “As long as the trade tension between China and the US carries on, the hot play on rare earth stocks will remain there.”

What leverage does China’s rare earths dominance hold in trade war?

China dominates global supply of rare earths, 17 elements on the periodic table with names like europium and ytterbium that share similar chemical and physical properties. It is the world’s biggest refiner of the metals, accounting for 90 per cent of global production, while the US is the largest importer, with 59 per cent of its imports sourced from China.

Traders cheered the moves, anticipating that the attention by the top policymakers to the industry will lead to a rapid increase in rare earth prices. Such optimism has been quickly reflected in the stock market.

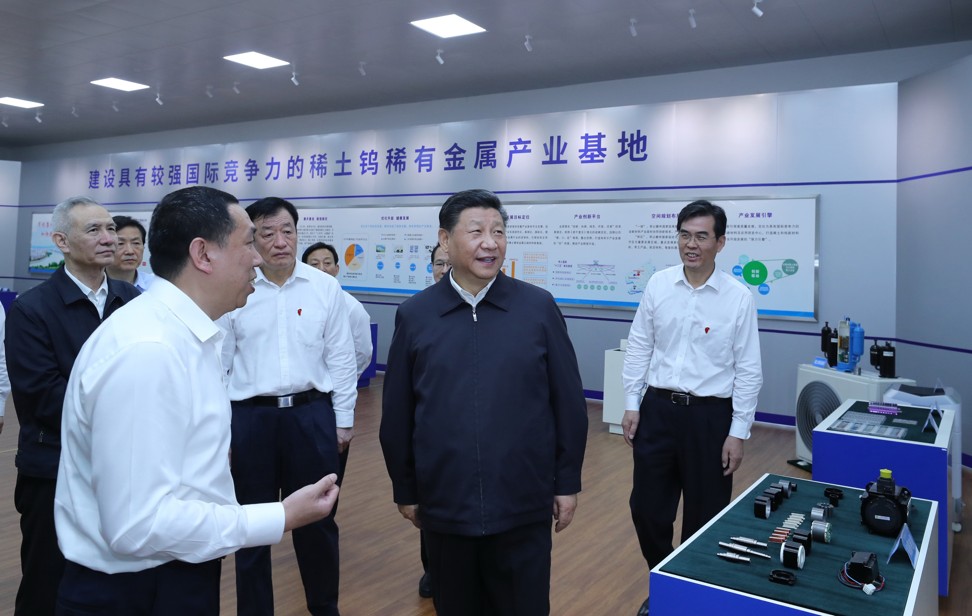

Shares of JL MAG Rare-Earth, the company visited by President Xi last month, have surged 191 per cent over the past month. China Minmetals has climbed 52 per cent in the period and China Northern Rare Earth 34 per cent.

China counts its rare earth blessings as ban speculation persists

Still, some investors remain vigilant of the outsize gains, arguing mere policy support will not translate into an immediate improve in earnings.

“The outlook of the sector largely hinges on the progress in the trade war,” said Wu Kan, an investment manager at Soochow Securities in Shanghai. “If there’s a detente, the rally will lose its momentum quickly. It’s mostly an event-driven thematic investment and these stocks are good for day trading, but not a long-term buy given no sign of a pickup in earnings.”

Double whammy of tariffs for US maker of rare earths alternative

Even by the standard of the median estimate of earnings for next year, JL MAG trades at a multiple of 107 times, according to Bloomberg data. China Northern Rare Earth is valued at 79 times, the data showed. The prices of so-called heavy rare earths, which are used in batteries for new-energy cars and in defence applications, have risen 30 per cent this year.

It is not the first time that China has banked on its global dominance of rare earth supply to exert influence in resolving political disputes. In 2010, China suspended exports of the metals to Japan for two months and subsequently announced a massive cutback on export quotas in a territorial conflict with its neighbour. That drove up prices of the raw materials by at least six fold.

US moves to reduce reliance on China for rare earths

For Gerry Alfonso from Shenwan Hongyuan Group, rare earth stocks may be in for a wilder ride going forward, with the Group of 20 meeting that presidents Donald Trump and Xi will attend drawing nearer. It remains unknown whether Xi and Trump will meet and engage in further talks at the two-day summit scheduled through June 29 in Japan. Trump demanded a meeting with his Chinese counterpart, threatening to raise tariffs again otherwise.

“In my base case scenario, some of those stocks still have upside, because they are easy to forecast stable cash flows as well as a low base effect,” said Alfonso, director of international business department at the Shanghai-based brokerage. “However, the macro environment remains unclear, likely adding volatility in the short term.”